In the equipment rental business, the sticker price of a new skid steer or excavator is just the tip of the iceberg. The full lifecycle cost of a piece of rental equipment — including maintenance, insurance, downtime, and depreciation — typically runs 2× to 3× the original purchase price. If you are making purchasing decisions based solely on the upfront cost, you are likely bleeding profit margins through the back door.

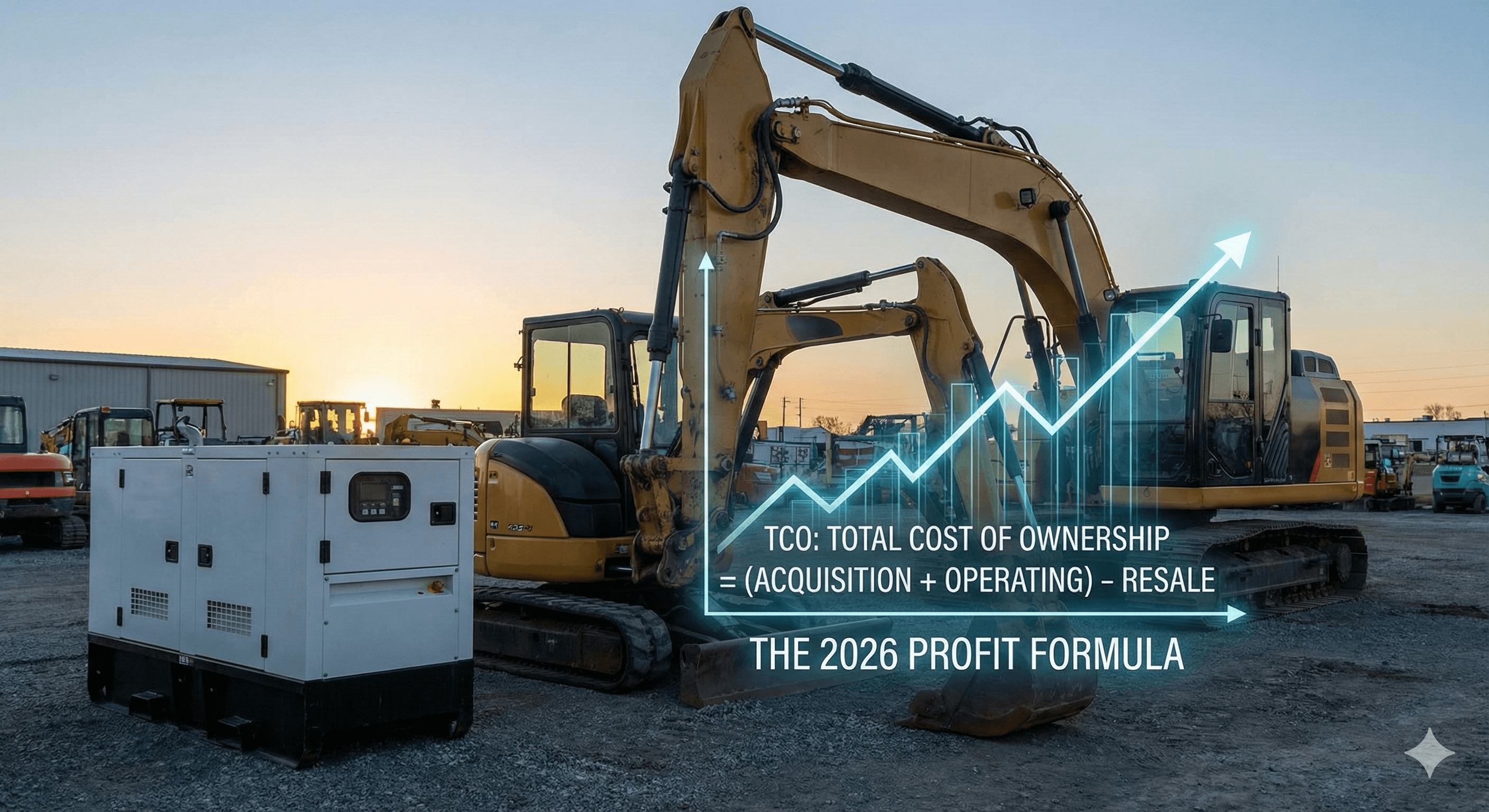

The most successful fleet owners in 2026 don't obsess over acquisition cost — they obsess over Total Cost of Ownership (TCO). Understanding TCO is the difference between a fleet that merely exists and a fleet that generates consistent cash flow.

Last updated: February 2026

Key Takeaways

- Total Cost of Ownership (TCO) is calculated as (Acquisition Cost + Operating Costs) – Resale Value — and "Operating Costs" is where most rental companies dramatically underestimate.

- Reactive (break-fix) maintenance costs 3× to 4× more than preventive maintenance — and causes reputational damage when machines fail on a customer's job site.

- "Ghost assets" — equipment on your books that isn't generating revenue due to unknown location or status — are one of the most common hidden TCO inflators in rental fleets.

- Engine hour-based maintenance scheduling (instead of calendar-based) can extend asset lifespan and significantly increase resale value at auction.

- A documented digital maintenance log from a telematics platform can increase equipment resale value by giving buyers verified proof of asset health.

What is TCO in the Rental Industry?

What is Total Cost of Ownership (TCO)?

Total Cost of Ownership is a financial estimate that captures the full direct and indirect costs of an asset over its entire lifecycle — from purchase through operation to disposal. For equipment rental companies, TCO answers: "How much does this machine actually cost me to keep on the lot versus how much it earns?"

The TCO Formula

(Acquisition Cost + Operating Costs) – Resale Value = TCO

The "Operating Costs" variable is where most businesses fail. This includes maintenance, insurance, storage, taxes, and — crucially — downtime. Every day a machine sits idle, it's still depreciating, still insured, and still costing you storage space while generating zero revenue.

The 3 Hidden Costs Eating Your Margins

1. "Ghost Assets" & Low Utilization

A "Ghost Asset" is a piece of equipment that appears on your ledger but is missing, stolen, or simply sitting in a corner of the yard unused for months. If you own a generator that costs $200/month to insure and store but hasn't been rented in 90 days, its TCO is skyrocketing while its revenue is zero. This challenge is often compounded by staffing constraints; as we discuss in our guide on solving the construction labor shortage, inadequate workforce visibility can make it even harder to track and manage your equipment assets.

Utilization is the single biggest lever on TCO. As we broke down in our 2026 fleet utilization benchmarks, most equipment classes should target 65–75% time utilization — and ghost assets are the most common reason fleets fall short. Managing ghost assets effectively requires knowing exactly where your equipment is located and its rental status, which is why tracking systems are critical. For insights on how to implement multi-location fleet management, see our branch visibility guide.

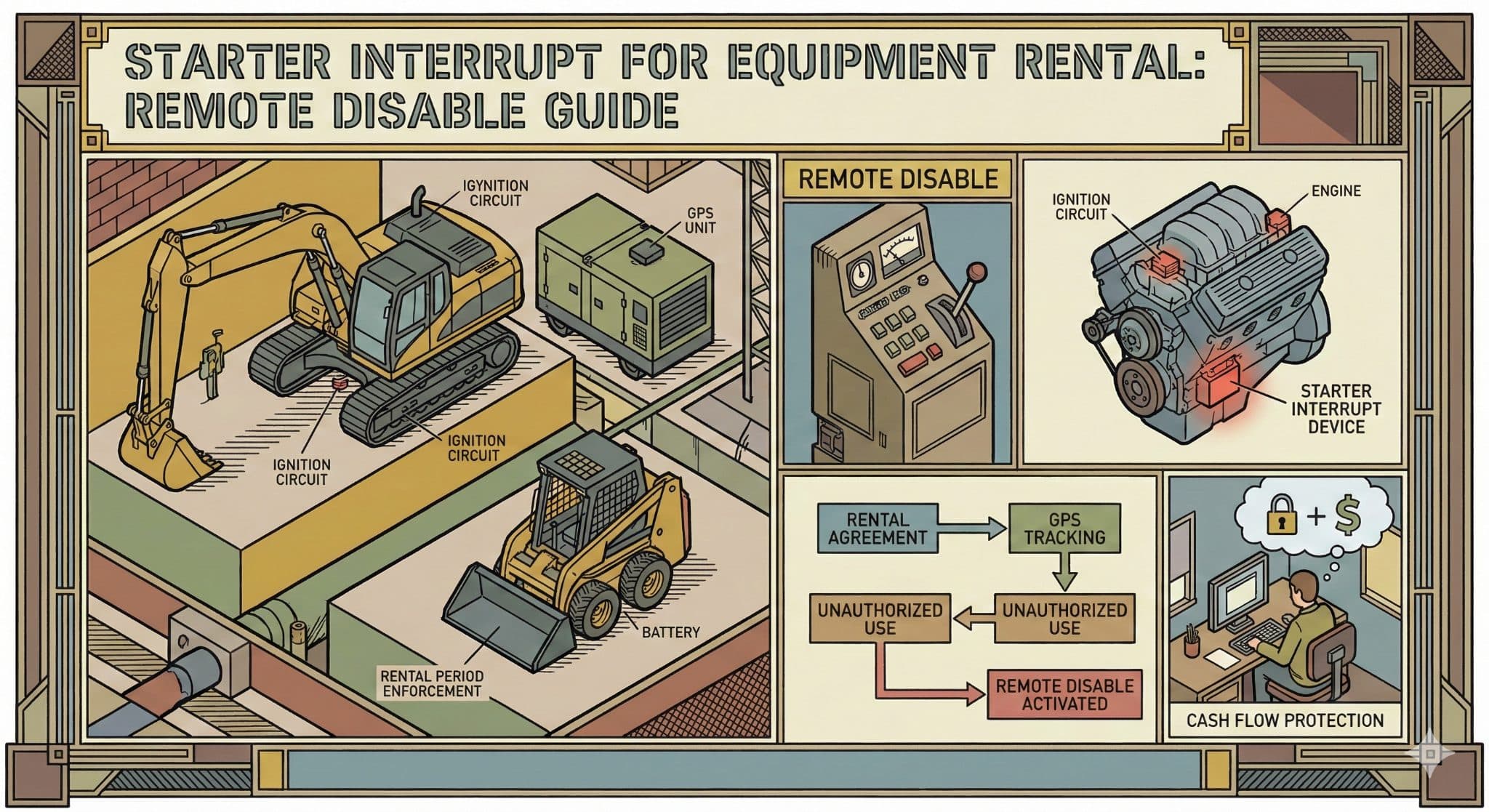

2. Reactive Maintenance

Waiting for a machine to break down before fixing it is the most expensive way to manage a fleet. Emergency repairs cost 3× to 4× more than preventive maintenance. Furthermore, if a machine breaks down while on a customer's job site, you face reputational damage and potential "down-rent" refunds.

The fix is straightforward: schedule maintenance by engine hours, not calendar days. A dozer that runs 14-hour shifts needs service far sooner than one sitting idle between jobs — but a calendar-based schedule treats them identically.

3. Insurance & Risk

Insurance premiums are a massive chunk of TCO. As we discussed in our guide to equipment rental insurance, theft and damage claims drive premiums up. Construction equipment theft alone costs the industry over $1 billion annually, with less than 25% of stolen assets ever recovered. If you cannot recover stolen assets quickly, your insurance costs will inflate your TCO year over year.

Know Your Real Operating Costs

Stop letting ghost assets, reactive repairs, and insurance claims quietly eat your margins. See your entire fleet's TCO in one dashboard — no contracts, transparent pricing.

Get a Custom Quote →How Telematics Reduces TCO

You cannot manage what you do not measure. This is where modern GPS tracking transforms from a "security tool" into a "profit tool." Here is how data impacts the TCO equation:

- Utilization Tracking: Identify assets that have < 20% utilization. Sell them to recover capital, or move them to a branch with higher demand. Hapn's equipment rental tracking gives you utilization data across your entire mixed fleet — regardless of OEM — in a single dashboard.

- Usage-Based Maintenance: Stop servicing machines based on "calendar days." Use Hapn's engine hour tracking to schedule maintenance exactly when the manufacturer recommends (e.g., every 500 hours). This extends the asset's lifespan and resale value.

- Billing Accuracy: Are customers renting for a "day" but using the machine for 18 hours? Telemetry data proves actual usage, allowing you to bill for overages and increase revenue per asset. For scenarios involving complex multi-site deployments with tight margins, consider how dynamic pricing strategies can help maximize revenue during peak demand periods.

- Theft Recovery & Deterrence: Real-time geofencing and movement alerts through Hapn's theft recovery tools let you respond within minutes — not days — when equipment is moved without authorization. Faster recovery means lower insurance claims and lower premiums over time.

The Bottom Line: Resale Value

The final part of the TCO formula is Resale Value. When it's time to off-fleet a machine, buyers want proof of health. A digital log of engine hours, maintenance records, and usage history (provided by your telematics system) can significantly increase the auction or resale price of used equipment.

A higher resale value lowers your overall TCO. This is one of the strongest arguments for a unified fleet data platform — not just for daily operations, but for the day you sell.

Written by the Hapn Team

Hapn provides GPS fleet and asset tracking for 50,000+ customers across construction, equipment rental, and 50+ other industries. Our platform processes over 4 billion messages annually with 99.9% uptime.

FAQ: TCO for Rental Fleets

What is Total Cost of Ownership (TCO) for equipment?

TCO is the comprehensive cost of an asset over its entire lifecycle. It is calculated by adding the Acquisition Cost (what you paid) plus Operating Costs (maintenance, insurance, fuel, storage, downtime), and then subtracting the Resale Value. For rental fleets, the lifecycle cost of a machine typically runs 2× to 3× the original purchase price.

How does GPS tracking reduce TCO?

GPS tracking reduces TCO in three ways: it optimizes maintenance by tracking actual engine hours instead of calendar days, preventing expensive breakdowns that cost 3–4× more than preventive service. It reduces theft risk through real-time geofencing and alerts, which can lower insurance premiums. And it identifies underutilized "ghost assets" that should be sold to recover capital. Hapn's platform unifies all of this data across mixed fleets regardless of OEM.

Why is idle time so expensive for rental equipment?

Idle time destroys TCO because the asset continues depreciating and incurring fixed costs — insurance, storage, taxes — without generating any revenue. A $200,000 excavator sitting idle for 90 days can cost $5,000–$10,000+ in carrying costs alone. Tracking idle time with telematics lets you either move equipment to higher-demand locations or off-fleet it to recover capital.

What is a ghost asset in equipment rental?

A ghost asset is equipment that appears on your books but isn't generating revenue — either because its location is unknown, it's waiting on parts with no ETA, or it's stuck in a status limbo between "returned" and "ready to rent." Ghost assets are one of the most common hidden causes of poor utilization and inflated TCO in rental fleets that still track inventory manually.

How does maintenance scheduling affect equipment resale value?

Equipment with a documented, engine hour-based maintenance history consistently sells for more at auction than identical machines without records. Buyers want proof that service was performed at OEM-recommended intervals — not just on arbitrary calendar dates. A telematics platform like Hapn provides a verifiable digital log of engine hours, service events, and usage patterns that directly supports higher resale prices.

Stop Guessing Your Operating Costs

Identify ghost assets, automate maintenance scheduling, and lower your TCO with real-time fleet data. No contracts, transparent pricing.

Get Pricing →