Managing a construction fleet in 2026 is no longer just about knowing where your excavators are. It's about managing a chaotic mix of heavy yellow iron, foreman pickup trucks, flatbed trailers, and rental generators—often spread across five different job sites. GPS tracking for construction equipment solves this by using hardwired telematics, battery-powered sensors, and OEM data streams to centralize location, engine health, and usage data into one dashboard. For modern mixed fleets, this unified approach reduces theft risk, automates maintenance scheduling, and creates a single source of truth for job costing.

This guide walks through how to choose the right tracking device for equipment at every level — from excavators with full CAN bus diagnostics down to unpowered trailers that need long-life battery GPS — and how to deploy construction equipment tracking across your entire mixed fleet without bouncing between portals.

Key Takeaways

- Construction equipment theft costs the industry over $1 billion annually; the "Ghost Tracker" method significantly increases recovery odds.

- Switching from reactive to predictive maintenance using CAN bus fault codes can reduce unplanned downtime by 30%.

- Automated job costing via geofencing eliminates billing disputes and improves project margin visibility.

- Modern mixed fleets require a platform that handles OSHA compliance, DOT logs, and heavy equipment diagnostics in one view.

Last updated: February 2026

The "Mixed Fleet" Reality: Why Single-Point Solutions Fail

If you run a construction company, your fleet isn't uniform. You likely own a combination of:

- Heavy Equipment: Dozers, excavators, skid steers (high value, moved infrequently).

- Road Vehicles: F-150s, dump trucks, fuel trucks (high mobility, driver behavior risks).

- Unpowered Assets: Trailers, compressors, message boards, tool cribs (easy to lose, hard to track).

- Rentals: Short-term equipment plugged into your job sites.

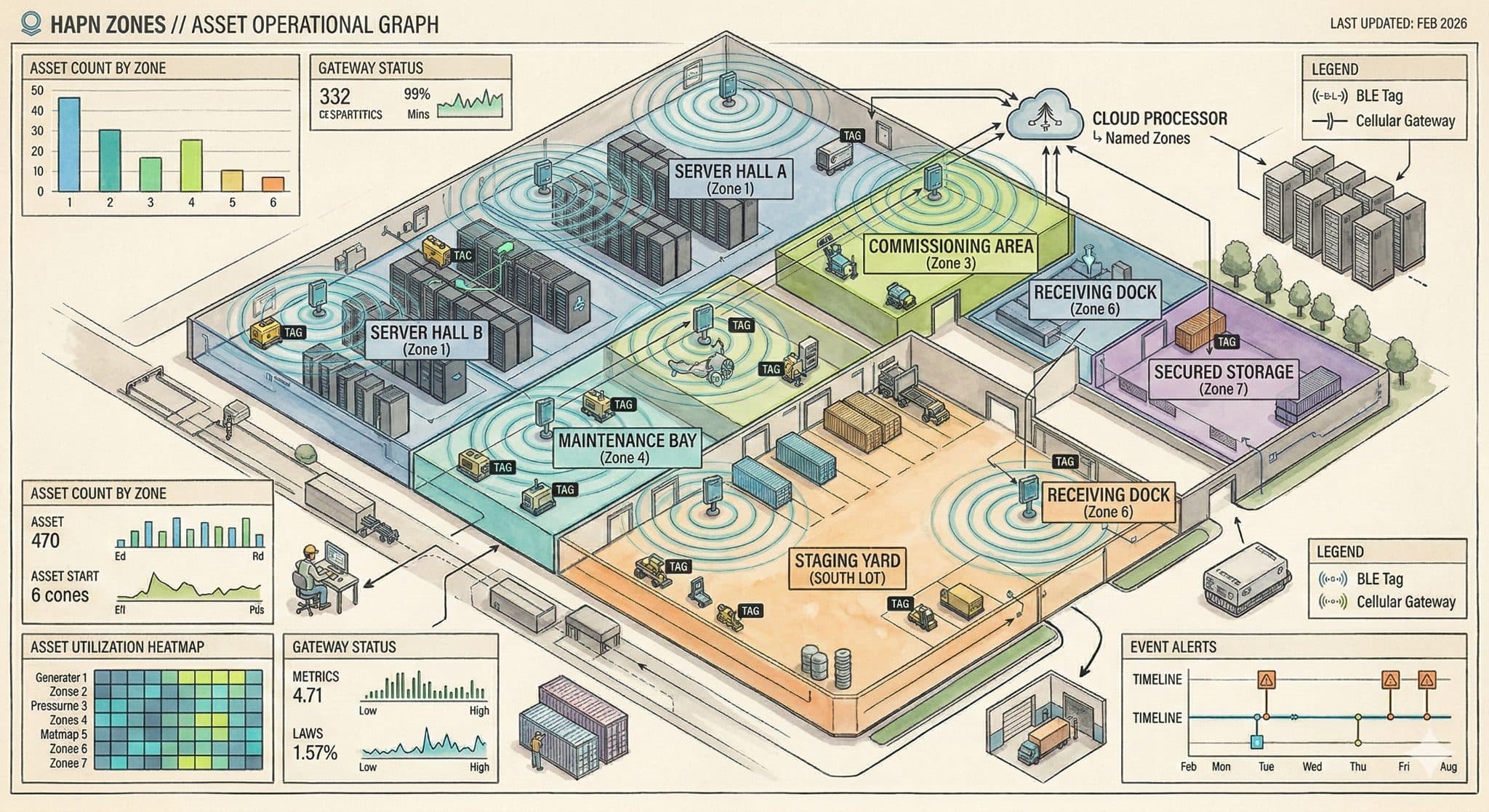

Historically, solving this required "portal hopping." You might use Hapn's construction fleet tracking for your trucks, but rely on a separate OEM portal (like VisionLink) for your heavy equipment, and maybe a third legacy system for trailers. This fragmentation kills efficiency. Dispatchers can't see which trailer is nearest to a job site because the trailer data lives in a different browser tab than the truck data.

The standard for 2026 is unified telematics. A single platform must ingest data from all these sources—hardwired trackers, OBD dongles, battery assets, and OEM feeds—to provide a complete operational picture.

Hardware Deep Dive: Ignition Wire vs. CAN Bus

Not all "hardwired" tracking is created equal. When speccing out equipment management solutions, you will typically choose between a simple 3-wire installation and a full CAN bus integration. Understanding the difference is critical for scaling operations.

Level 1: Ignition Sense (The "3-Wire" Install)

This connects to power, ground, and ignition. It tells you where the machine is and whether the engine is on. Best for: Smaller fleets, older equipment (pre-2010) without standard ECUs, or lighting towers/generators where engine health data isn't critical. The Limit: You know the machine ran for 8 hours, but you don't know if it was idling for 6 of them, or if it was overheating the entire time.

Level 2: Full CAN Bus / J1939 Integration

For high-value assets (excavators, loaders, graders), you need to tap into the machine's brain (the ECU). Hapn's advanced devices read the J1939 protocol to extract:

- Real Engine Hours: Matches the dashboard hour meter exactly.

- Fault Codes (DTCs): Instant alerts for "Low Hydraulic Pressure" or "High Coolant Temp."

- Fuel Burn & Idling: Distinguishes between working hours and idling hours.

- DEF Levels: Prevents derating incidents by alerting you when Diesel Exhaust Fluid is low.

What is J1939 CAN Bus?

J1939 is the standard communications protocol used by heavy-duty vehicles and construction equipment. A "CAN bus" integration reads this data stream directly from the machine's computer (ECU), allowing telematics devices to capture advanced diagnostics like fuel consumption, RPM, and engine fault codes rather than just location.

Why this matters at scale: If you have 5 machines, you can walk around and check dashboards. If you have 50 machines across 3 counties, you need the equipment to tell you it's sick before it fails. Moving from reactive repairs to predictive engine hour-based maintenance is how mature fleets protect their margins. Industry data consistently shows that this shift can reduce unplanned downtime by up to 30%. For contractors managing labor-intensive operations, predictive maintenance also ensures equipment is ready when crews arrive on site.

Choosing the Right Platform: Vertical vs. Horizontal

When selecting a GPS provider, you will generally encounter two types of vendors. Understanding the difference is critical to avoiding a fragmented tech stack.

The "Construction Only" Specialists (e.g., Trackunit)

Platforms like Trackunit are excellent at heavy equipment data. They speak the language of construction. However, they typically do not support road vehicles (trucks/vans) or AI dash cameras on the same platform. If your fleet includes 20 pickups and 15 trailers alongside your yellow iron, you will be forced to buy a second system for those vehicles.

The "Vehicle First" Giants (e.g., Samsara, Verizon Connect)

These platforms are designed for trucking and logistics. They are fantastic for ELD compliance and route optimization. However, their heavy equipment support is often an afterthought—providing basic location dots but missing the deep fault codes, hydraulic data, and specialized reporting that heavy machinery requires.

The Unified Solution: Hapn

Hapn is unique because it is a full-stack mixed fleet platform. We don't force you to choose between deep equipment data and advanced vehicle tracking. Hapn provides:

- Full Equipment Telematics: Engine hours, fault codes, diagnostics, and CAN bus data that matches the depth of construction-only platforms.

- Full Vehicle Tracking: Speed, idle time, driver behavior, and trip history for your road fleet.

- Asset Tracking: Long-life battery trackers for trailers and attachments.

- AI Dash Cameras: Integrated video safety for liability protection.

| Feature | OEM Portal (e.g., VisionLink) | Vehicle-First (e.g., Verizon) | Unified Platform (Hapn) |

|---|---|---|---|

| Diagnostic Depth | Excellent (Brand specific) | Basic (Location/Ignition) | Excellent (J1939 CAN Bus) |

| Mixed Fleet Support | Poor (Only their brand) | Good for trucks, poor for equipment | Excellent (Vehicles + Equipment + Assets) |

| Theft Recovery | Passive | Standard | Active (Ghost Tracker + Recovery Mode) |

| Contract Terms | Varies by dealer | Long-term lock-in (3+ years) | Transparent, No Contracts |

The "Ghost Tracker" Strategy: An Insurance Policy for High-Value Assets

Theft is becoming more sophisticated. Thieves know how to spot a standard equipment tracking device installed under the dashboard or near the fuse box. They rip them out within seconds of stealing the machine.

To combat this, leading construction firms are deploying the "Ghost Tracker" strategy using Hapn's battery-powered asset trackers. In fact, ghost trackers provide a hidden layer of protection that significantly improves recovery odds when the primary tracker is disabled.

- The Decoy: Install your standard hardwired telematics device in the usual spot. This provides your daily operational data (engine hours, fuel, etc.).

- The Ghost: Hide a second, small battery-powered tracker deep inside the frame, welded inside a bucket attachment, or under a seat. These devices (like the Hapn Atlas) are self-powered, sleep 99% of the time to evade bug sweepers, and can last 5-7 years on a single battery.

When a thief disables the main unit, they think they are safe. You then activate "Recovery Mode" on the Ghost unit via Hapn's theft recovery tools, which wakes up the device to ping its location every few seconds, leading police directly to your asset. This dual-layer approach is the only reliable way to recover high-value yellow iron in 2026.

Job Site Challenges: Why "Rugged" Matters

Construction isn't logistics. Equipment sits in mud, gets pressure washed, vibrates constantly, and operates in cellular dead zones. A consumer-grade tracking device for equipment fails in these environments within weeks.

- IP67 Rating is Non-Negotiable: Your hardware must be waterproof and dust-tight.

- Store-and-Forward Technology: Remote job sites often have spotty cellular coverage. Hapn devices detect when they lose signal, store up to 20,000 data points locally on the device, and automatically upload the history the moment the machine returns to coverage. This ensures you never lose engine hour data just because a dozer was working in a valley.

- Voltage Spikes: Heavy equipment electrical systems are noisy. Industrial-grade trackers have built-in voltage protection to handle the surges that occur when cranking a massive diesel engine.

Compliance: OSHA, DOT, and Safety

Beyond location, your telematics system acts as your automated compliance officer.

OSHA & Maintenance Logs

OSHA requires regular safety inspections and maintenance records for heavy equipment. Doing this on paper is a liability risk. Hapn digitalizes this process. When a machine hits a service interval (e.g., 500 hours), the system logs it and notifies the shop manager. You have a digital, unalterable audit trail proving that maintenance was performed on schedule.

DOT Compliance for Road Vehicles

Your dump trucks and heavy haulers fall under DOT regulations. A unified platform allows you to manage vehicle tracking and driver safety alongside your yellow iron. You can track hours of service, monitor for harsh braking or speeding events, and maintain digital driver vehicle inspection reports (DVIRs) in the same app where you track your skid steers.

Integrating Telematics into Job Costing

The disconnect between field operations and the back office is a major source of profit leak. If you bid a job assuming 40 hours of excavator time, but the machine actually ran for 60 hours, your margin is gone. If you don't catch that until the end of the month, it's too late.

By integrating Hapn's data via our open API, you can feed telematics data directly into project management systems like Procore or ERPs like Sage.

- Automated Cost Allocation: Create a geofence around "Project A." The system automatically tallies every engine hour used inside that fence and allocates the cost to that specific job code.

- Billing Verification: Eliminate disputes with general contractors or clients. You have a timestamped, GPS-verified record of exactly when your equipment was running on their site.

- Change Order Justification: When a client asks for "just a little more work," you can show exactly how much additional equipment time that request consumed.

Choosing the Right Partner: Transparency Matters

When selecting a GPS provider, pay attention to the business model, not just the hardware. Many legacy providers operate on a rigid contract model, locking you into 36-month agreements that auto-renew. In the volatile construction industry, where fleet sizes fluctuate with project wins and losses, flexibility is key.

Hapn operates on a transparent, no-contract model. We believe you should stay because the product works, not because a legal team trapped you. Whether you need to outfit a 5-truck landscaping crew or a 200-asset general contracting fleet, the pricing is clear, and the data belongs to you. For a detailed product comparison and deeper insights into how different trackers meet your fleet's specific needs, see our guide to the best GPS trackers for heavy equipment in 2026. You can also see our guide on fleet utilization benchmarks to see how this data translates to ROI.

Stop Guessing. Start Tracking.

See how Hapn gives you complete visibility across your mixed fleet — vehicles, equipment, and assets in one platform. No contracts, transparent pricing.

Get Pricing →Written by the Hapn Team

Hapn provides GPS fleet and asset tracking for 50,000+ customers across construction, equipment rental, and 50+ other industries. Our platform monitors 463,000+ assets and processes over 4 billion messages annually with 99.9% uptime.

Frequently Asked Questions

What is the best tracking device for construction equipment?

The best tracking device for construction equipment depends on the asset type and power source. For powered machines like excavators, a hardwired equipment tracking device connected to the CAN bus is best as it captures engine hours and diagnostics. For unpowered assets like trailers, a long-life battery-powered asset tracker is ideal. Hapn offers both hardware types on a single platform to cover your entire mixed fleet.

Can I track equipment where there is no cellular service?

Most modern GPS trackers, including Hapn's, rely on cellular networks (LTE/Cat-M1) to transmit data. If you are operating in extremely remote areas with zero cellular coverage, Hapn devices use "store-and-forward" technology to save data locally and upload it automatically once the machine returns to coverage. For permanent zero-cell sites, satellite solutions like Geoforce are the alternative.

How does GPS tracking prevent construction equipment theft?

GPS tracking prevents theft through real-time geofencing alerts and the "Ghost Tracker" method. If a machine moves outside a designated job site after hours, the system notifies managers instantly. For high-value assets, hiding a secondary battery-powered tracker ensures recovery even if thieves disable the primary telematics unit.

Does Hapn integrate with construction ERP software?

Yes, Hapn features a production-grade Open API that allows you to feed telematics data directly into construction ERPs, rental management software, and maintenance platforms. This enables automated job costing, validated billing, and streamlined maintenance workflows without manual data entry.

Secure Your Job Site Today

Don't let equipment theft or downtime eat into your margins. Get full visibility for your entire construction fleet with Hapn.

Get Pricing →