For construction firms and equipment rental houses, the question "where is my stuff?" is only the tip of the iceberg. In an era where margins are squeezed by rising fuel costs and equipment lead times, true operational efficiency requires more than just a dot on a map. It requires a deep dive into engine hours, fuel burn, and diagnostic health across a fragmented fleet of Caterpillar, John Deere, and Komatsu iron.

Managing a mixed fleet often feels like managing several disparate businesses at once. Each OEM provides its own telematics portal, leading to "portal hopping" fatigue. This guide breaks down how to implement heavy equipment GPS tracking that unifies your data, secures your assets, and actually moves the needle on your bottom line.

What is a Mixed Fleet?

A mixed fleet is any fleet containing multiple asset types—vehicles (trucks, vans), powered heavy equipment (excavators, generators), and unpowered assets (trailers, containers)—that traditionally require separate tracking platforms to monitor.

What's Inside This Guide

- Why Heavy Equipment Tracking is Different from Vehicles

- Solving the OEM Portal Fragmentation Problem

- Comparison: OEM Telematics vs. Aftermarket Solutions

- The Real ROI: Hard Numbers on Idle and Maintenance

- Advanced Security: Geofences and Ghost Trackers

- Integrating GPS Data into Your ERP/Rental Software

About Hapn

Hapn is a full-stack GPS fleet and asset tracking platform for midmarket and enterprise companies, providing equipment telematics, vehicle tracking, AI dash cameras, and battery-powered asset monitoring on a single dashboard — with transparent pricing and no long-term contracts.

Why Heavy Equipment Tracking is Different from Vehicle Tracking

Many providers try to sell standard vehicle trackers for yellow iron. This is a fundamental mistake. Heavy equipment operates in a completely different universe than a standard fleet vehicle, and your heavy equipment gps tracking strategy must reflect that.

First, consider the data source. While trucks use standardized OBD-II ports, heavy equipment relies on J1939 or J1708 CAN-bus protocols. Tapping into these systems requires specialized harnesses and an understanding of how specific manufacturers report data. Furthermore, in the world of Hapn's equipment tracking solution, mileage is a secondary metric. The "heartbeat" of a machine is its engine hours—the primary driver for billing, maintenance, and depreciation.

Finally, there is the environment. A tracker tucked under the dash of a van won't survive the high-vibration environment of a skid steer or the high-pressure washdowns of a rental return bay. Hardware must be IP67-rated and ruggedized to ensure the total visibility you're paying for doesn't go dark after the first rainstorm.

The OEM Fragmentation Problem: Solving "Portal Hopping"

If you have a mixed fleet, you're likely familiar with the struggle of logging into five different websites. Your Cat machines are in VisionLink, your Deeres are in JDLink, and your trailers have no tracking at all. This fragmentation makes it impossible to get a unified view of your business performance.

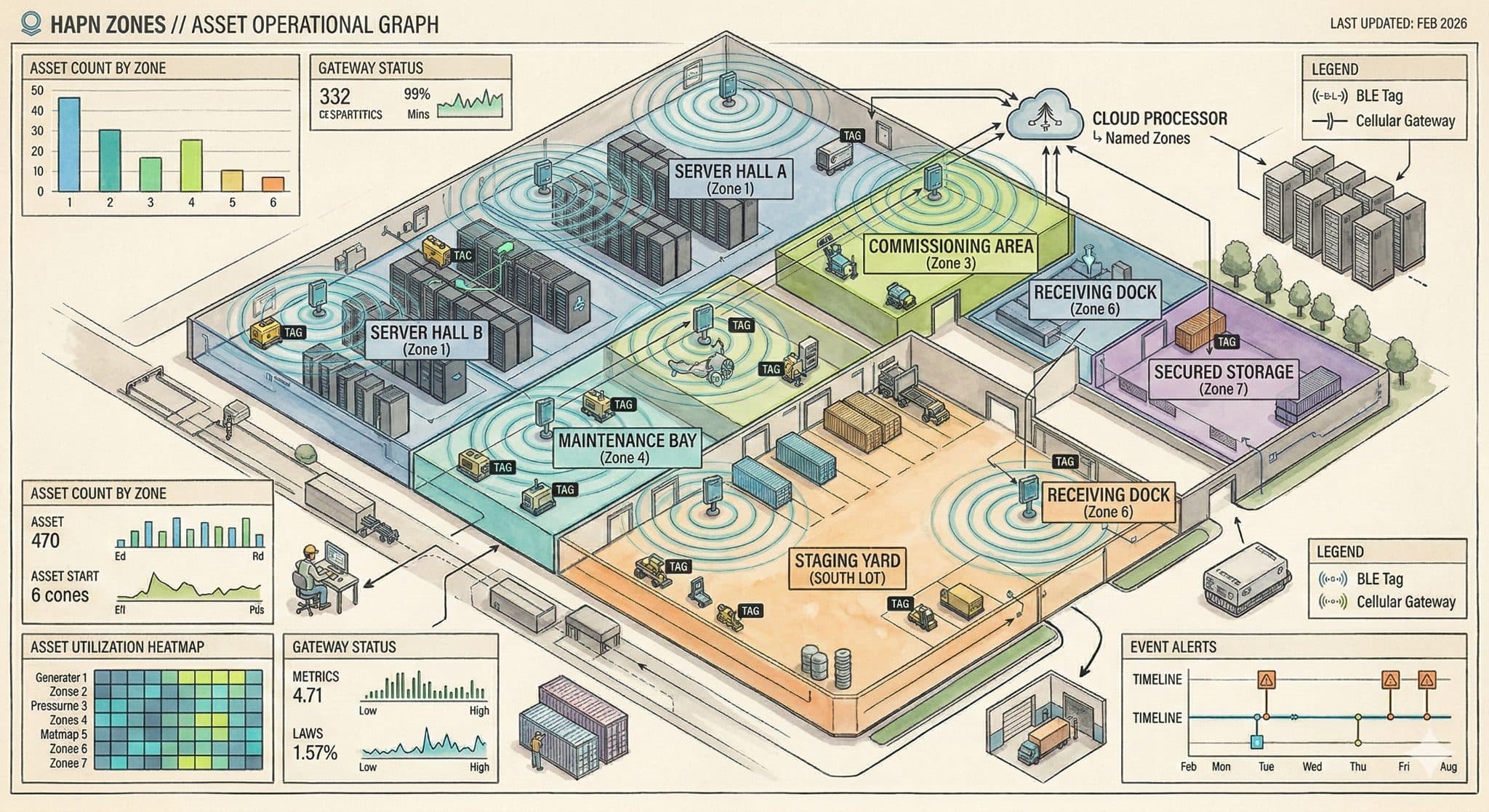

The solution isn't to ignore OEM data—it's to unify it. As we covered in our guide to AEMP unified fleet data, the industry standard allows third-party platforms to ingest OEM feeds via API. By combining these feeds with aftermarket Hapn asset trackers on your non-powered equipment, you finally get a single pane of glass for your entire operation. For security-focused fleets, adding a "Ghost Tracker" with hidden battery-powered backup provides comprehensive protection against theft. And when managing job site operations efficiently, centralized tracking data becomes your competitive advantage.

Is This Guide For You?

This level of heavy equipment tracking is designed for construction firms and rental houses managing 20+ units. If you are struggling with manual hour-tracking, missing equipment, or "black holes" in your fleet data, you have likely outgrown basic GPS and need a sophisticated platform built for the midmarket.

Comparison: OEM Telematics vs. Aftermarket Solutions

For many equipment owners, the question isn't whether to use telematics, but which hardware to trust. While OEM systems are powerful, they are often "walled gardens."

| Feature | OEM Factory Telematics | Hapn Aftermarket Tracking |

|---|---|---|

| Fleet Visibility | Brand-specific only. | Universal across all brands & assets. |

| Reporting Depth | Deep manufacturer-specific diagnostics. | Standardized KPIs across the whole fleet. |

| Data Access | Often restricted to proprietary portals. | Open API for ERP/Software integration. |

| Non-Powered Assets | Rarely supported. | Full support for trailers and attachments. |

The Real ROI: Hard Numbers on Idle and Maintenance

Investing in gps trackers for heavy equipment isn't just an expense; it's a cost-recovery strategy. When you move from manual logs to automated construction fleet tracking, the financial impact is immediate.

- Fuel Savings: Our customers typically see a 15-20% reduction in idle-time fuel waste within the first 90 days. For a single excavator, cutting just two hours of daily idle time can save over $3,000 per year in fuel alone.

- Billing Accuracy: Rental houses often lose 5-10% of their revenue to "under-reported" hours. Digital hour tracking ensures every minute a machine is running is captured for invoicing. Organizations that implement bulk actions for faster reporting can process billing updates in minutes rather than hours.

- Maintenance Extensions: By servicing equipment based on actual usage rather than the calendar, companies can often extend service intervals by 10-15% without compromising safety, as we detailed in our TCO guide.

Unify Your Mixed Fleet Today

See how Hapn bridges the gap between fragmented OEM data and your operations.

See the Mixed Fleet Platform →Advanced Security: Geofences and Ghost Trackers

Theft recovery is the most common reason businesses start looking for heavy equipment telematics, but it's the strategy that determines if you actually get your machine back. Standard trackers are easily found by professional thieves.

Sophisticated fleets use a two-pronged approach. First, a hardwired tracker provides real-time data and immediate "tamper alerts." Second, they deploy a "Ghost Tracker" with hidden battery-powered backup. This is a secondary, battery-powered Hapn asset tracker hidden deep in the chassis. It remains dormant and invisible to electronic sweepers, waking up only if the primary unit is disabled. This redundancy is what turns a total loss into a theft recovery success story.

Integrating GPS Data into Your Business Ecosystem

In 2026, the value of heavy equipment tracking is realized when the data leaves the tracking platform and enters your business workflow. Your tracking system should act as the "source of truth" for:

- ERP & Accounting: Pushing hour data directly into systems like Sage or Viewpoint for job costing.

- Rental Management: Automating the "check-in" process when a machine returns to the yard via geofencing.

- Maintenance Management: Triggering work orders automatically the moment a machine hits its 500-hour service interval.

By using the Hapn API, you can ensure that your fleet data is working for your dispatchers, mechanics, and accountants simultaneously, providing team management tools that go far beyond simple location.

Summary of Benefits

- Stop "portal hopping" by unifying OEM and aftermarket data.

- Reduce fuel costs by up to 20% through aggressive idle monitoring.

- Automate maintenance and billing with real-time engine hour reporting.

- Implement redundant "Ghost Tracking" to ensure 99% theft recovery rates.

FAQ: Heavy Equipment GPS Tracking

What is the best way to track a mixed fleet of heavy equipment?

Managing a mixed fleet is most effective when you use a platform that can ingest OEM data from manufacturers like Cat and John Deere while supplementing it with aftermarket hardware for older machines and non-powered assets. This creates a single source of truth for all your data.

Can I track engine hours on older equipment without telematics?

Older machines without digital brains can still be tracked using ignition-wire or vibration-based methods. Each of these has specific tradeoffs depending on your maintenance workflow and how accurately you need to distinguish between idle time and true work hours.

How does GPS tracking help with equipment rental billing?

Tracking helps eliminate billing disputes by providing a digital timestamp of exactly when a machine was used and for how long. This allows for automated "overtime" billing if a machine is used beyond the agreed-upon daily shift limits.

Is it possible to track equipment inside buildings or in remote areas?

While standard GPS requires a line of sight to satellites, modern heavy equipment trackers use a combination of cellular triangulation and high-sensitivity receivers to maintain a signal in challenging environments—though specific hardware choices matter significantly here.

How do I prevent thieves from finding and removing the tracker?

The most effective security strategy involves using a primary tracker for data and a secondary "ghost" unit that is hidden and dormant. This redundancy makes it significantly harder for thieves to fully "clean" a machine of its tracking capabilities before it can be recovered.

Stop Guessing. Start Tracking.

See how Hapn gives you complete visibility across your mixed fleet—vehicles, equipment, and assets in one platform.