Last updated: February 2026

What is a Fleet Tracking ROI Calculator?

A fleet tracking ROI calculator is a financial framework used to project the return on investment from telematics technology by quantifying savings in four primary areas: asset utilization, theft recovery, billing accuracy, and insurance premiums. For enterprise fleets, a positive ROI is typically achieved within 3-6 months. The guide and downloadable template below detail exactly how to calculate these figures for your specific business case.

Key Takeaways

- Utilization: Mixed fleets often see a 15-20% improvement in equipment utilization by identifying "ghost assets."

- Billing: Recovering just 2 hours of unbilled overtime usage per week can generate $10k+ in recovered revenue for rental fleets.

- Insurance: Major carriers frequently offer 5-15% premium discounts for fleets with verified GPS tracking and recovery protocols.

- Cost Structure: Hapn's transparent pricing model eliminates hidden contracts, immediately improving the Total Cost of Ownership (TCO) calculation.

What is Fleet Tracking ROI?

Fleet Tracking ROI is the measurable financial return from implementing GPS tracking technology, calculated as the sum of tangible savings (theft recovery, fuel efficiency, reduced downtime, improved utilization, and recovered billing) minus the cost of GPS hardware and subscription fees.

Building your business case?

Don't start from scratch. Get our pre-built Google Sheet model with formulas for utilization, theft, and maintenance savings.

Get ROI Template (Google Sheets) →When you walk into a CFO's office to request budget for a new technology platform, "peace of mind" is not a line item. CFOs operate in the language of P&L: hard dollar savings, risk mitigation, and capital efficiency.

For fleet managers in construction, equipment rental, or heavy enterprise logistics, knowing you need GPS tracking isn't enough. You have to prove that the cost of not tracking your mixed fleet is higher than the investment in a solution like Hapn's equipment tracking solution.

This guide serves as your blueprint. We will break down the specific variables you need to input into your fleet tracking ROI calculator to demonstrate value across theft, utilization, billing accuracy, and insurance.

1. Fleet Tracking ROI: Theft Prevention & Recovery Savings

The most immediate and tangible ROI comes from asset protection. While insurance covers replacement costs (eventually), it does not cover the project delay fees, increased premiums, or the administrative burden of filing claims.

According to the National Equipment Register, construction equipment theft exceeds $1 billion annually in the U.S. alone. Less than 25% of stolen assets are ever recovered without telematics. With Hapn, that recovery probability shifts dramatically in your favor. To understand the broader tracking landscape, explore our comprehensive guide on how asset tracking works.

The Formula for Theft ROI

To calculate your potential savings, look at your historical data over the last 3 years:

- A = Average Annual Value of Stolen Assets (Cost of equipment + Deductibles)

- B = Indirect Cost Multiplier (Industry standard is 1.5x to account for rental replacements and downtime)

- C = Annual Subscription Cost of Telematics

Projected Savings = (A × B) - C

2. Telematics ROI: Maximizing Utilization & Ghost Assets

For rental companies and large construction firms, capital efficiency is king. The biggest leakage in these industries is underutilization—assets that are deployed to a job site but sit idle, or "ghost assets" that are hoarded by site managers "just in case."

As we covered in our guide to Fleet Utilization Benchmarks, mixed fleets using a single tracking platform see an average 15-20% improvement in equipment utilization.

Real-world impact: One Hapn customer, a mid-sized construction firm with 200 assets, used utilization reports to identify that they were cross-renting excavators while owning three that sat idle in a remote yard. They eliminated $12,000 in monthly rental fees within 30 days of implementation.

| Scenario | Without Telematics | With Hapn Utilization Data |

|---|---|---|

| Asset Visibility | Reliance on field reports (often inaccurate) | Real-time location and ignition status |

| Capital Expenditure | Buying new assets when inventory feels "tight" | Redeploying idle assets instead of buying new |

| Rental Costs | High cross-rental spend | Reduced sub-rentals by maximizing owned fleet |

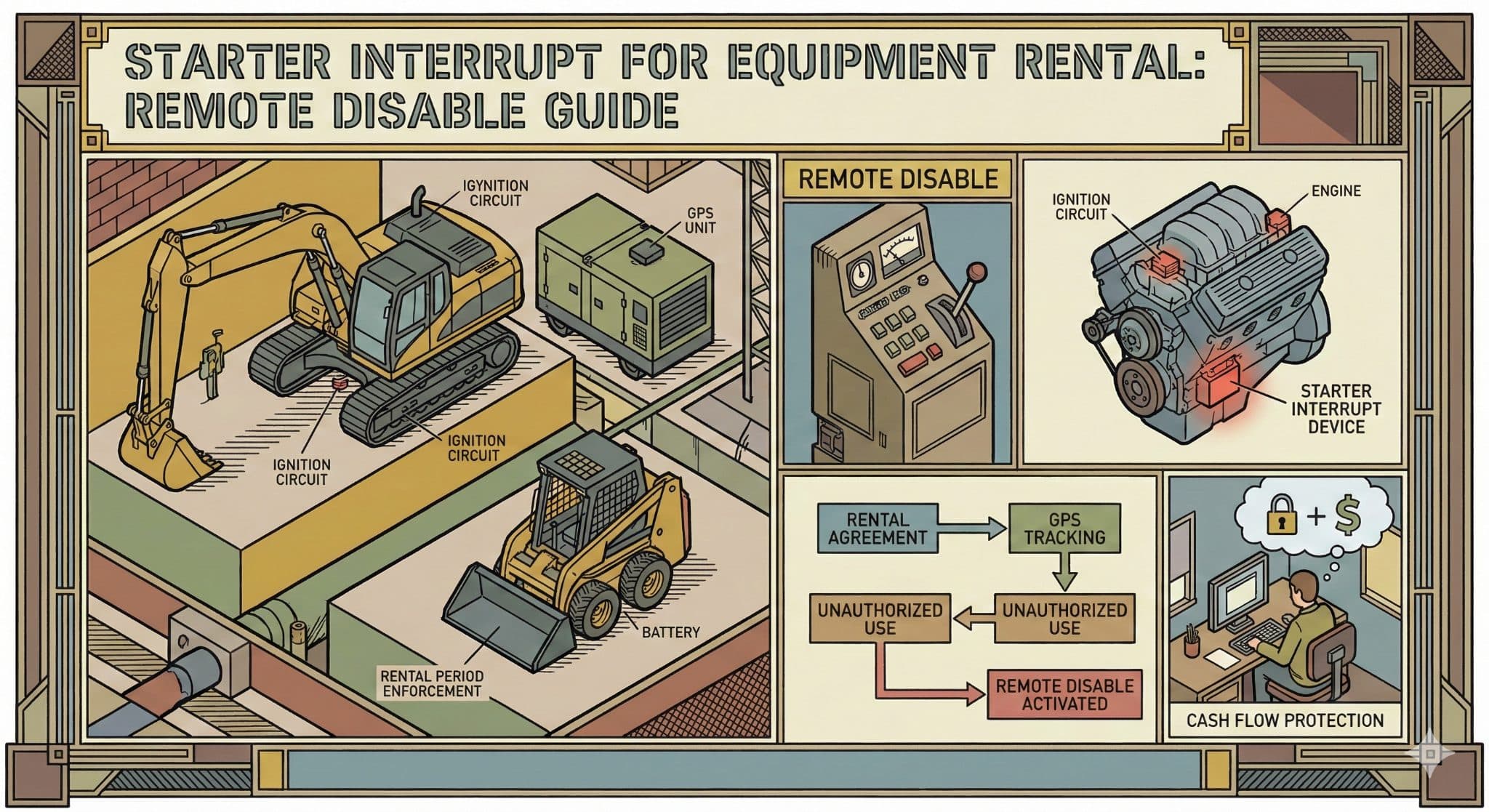

3. Billing Accuracy: How GPS Tracking Improves Revenue

For equipment rental companies, billing accuracy is often the difference between breaking even and profitability. If a client rents a boom lift for a "single shift" (8 hours) but runs it for 14 hours, you are losing revenue and depreciating the asset faster than you are being paid for.

Telematics provides irrefutable proof of usage. Integrating this data into your ERP allows for automated overtime billing. If you recover just 2 hours of overtime billing per week across a fleet of 50 machines at $100/hour, that is $10,000 per week in recovered revenue. For deeper context on asset management best practices, see our guide on types of asset tracking for professional services.

Need to track mixed assets?

From heavy yellow iron to battery-powered trailers, see everything on one map.

See Equipment Tracking in Action4. Insurance Premium Reductions

Insurance is one of the largest fixed costs for any fleet. Many carriers (including major providers like Zurich, Travelers, and Nationwide) offer premium discounts for fleets that deploy verified GPS tracking and recovery solutions.

Discounts typically range from 5% to 15% depending on the provider and the granularity of the data shared. Beyond the discount, the ability to prove operator safety behavior via AI Dash Cameras helps insulate your company from nuclear verdicts and liability claims, protecting your long-term insurability.

The Formula for Insurance ROI

(Annual Premium × Discount Rate) = Direct Cash Savings

Note: Ask your broker specifically about "telematics discounts" and "recovery device incentives" during your next renewal.

5. Operational Efficiency: Maintenance & Admin

The final pillar of your business case combines maintenance savings with administrative efficiency. This moves the conversation from "reactive repairs" to "predictive uptime."

What is TCO (Total Cost of Ownership)?

TCO is the comprehensive assessment of all costs associated with an asset, including acquisition, operation, maintenance, insurance, and eventual disposal. Reducing TCO increases the profit margin on every project. For deeper understanding, explore our comprehensive guide on what total cost of ownership means for rental equipment.

Without telematics, maintenance is often a guessing game. You might service a loader every 3 months regardless of whether it ran for 500 hours or 50 hours. Over-servicing wastes labor and parts; under-servicing leads to catastrophic failure.

Furthermore, mixed fleets often suffer from "portal hopping"—wasting hours logging into John Deere, CAT, and Ford portals separately. Hapn consolidates this data into a unified platform. If your fleet manager saves even 5 hours a week on data aggregation, that's 260 hours a year returned to high-value tasks like route optimization or safety training.

Build Your Custom ROI Model

Every fleet is different. A logistics company cares about fuel and route optimization (available via our Vehicle Tracking), while a rental company cares about engine hours and billing.

Don't want to build the spreadsheet yourself?

For enterprise fleets with over 100 units, Hapn's solutions engineering team will build a custom ROI model for you using your actual historical data. We help you quantify the savings specifically for your industry vertical, whether that's construction, oil & gas, or utilities.

Written by the Hapn Team

Hapn provides GPS fleet and asset tracking for 50,000+ customers across construction, equipment rental, and 50+ other industries. Our platform processes over 4 billion messages annually with 99.9% uptime.

Frequently Asked Questions

How do I calculate ROI for GPS fleet tracking?

To calculate ROI for GPS fleet tracking, sum your estimated annual savings from theft prevention, insurance discounts (typically 5-15%), billing accuracy, and maintenance efficiency. Divide this total savings figure by the annual cost of the telematics subscription. A positive ROI is usually achieved when the savings exceed the cost within the first 6 months.

What is the average ROI for fleet telematics?

While results vary by industry, most fleets see a return of $2 to $5 for every $1 spent on telematics. This is driven largely by reductions in fuel costs (10-15%), improved utilization (15-20%), and lower insurance premiums. Hapn customers specifically benefit from transparent pricing that improves this ratio by eliminating hidden fees.

Does Hapn offer a free ROI calculator?

Yes, we provide a downloadable spreadsheet template for self-serve calculations. For enterprise fleets (100+ assets), Hapn also offers a consultative ROI analysis where our team builds a custom business case using your historical data. You can request this consultation through our pricing page.

Stop Guessing. Start Tracking.

See how Hapn gives you complete visibility across your mixed fleet — vehicles, equipment, and assets in one platform. No contracts, transparent pricing.

Get Pricing →