Last updated: February 2026

Key Takeaways

- Dynamic pricing adjusts rental rates based on real-time demand, equipment availability, and market conditions to maximize fleet ROI.

- Tiered "good-better-best" pricing frameworks help segment your market and capture revenue from different customer profiles.

- Telematics data enables geo-intelligent and utilization-based pricing, transforming pricing from guesswork into a data-driven strategy.

- Responsive rate structures combine base rates, dynamic rules, and automation to maintain flexibility while simplifying operations.

- Transparent communication about pricing changes builds customer trust and can turn dynamic pricing into a competitive differentiator.

Dynamic Pricing Strategies for Heavy Equipment Rentals

Introduction: Heavy equipment rental companies operate in a highly competitive market where maximizing fleet ROI is paramount. Dynamic pricing has emerged as a powerful strategy to stay ahead – adjusting rental rates in response to real-time market conditions, demand, and asset usage. Unlike flat rate lists, dynamic pricing lets you boost revenue during high-demand periods and minimize idle time during slow periods. It's an approach that can benefit both short-term daily rentals and long-term leases by aligning prices more closely with actual value and demand. In the following sections, we explore practical pricing frameworks (like "good-better-best" packages) and advanced data-driven tactics. You'll also learn how telematics data (equipment usage, idle hours, location tracking) can inform smarter pricing, how to build flexible rate structures, and ways to communicate these dynamic rates transparently to customers. The goal is an authoritative yet accessible guide to help rental business owners improve profitability and customer satisfaction through smart pricing.

Embracing Dynamic Pricing in Equipment Rentals

Why adopt dynamic pricing? The key benefit is improved fleet utilization and ROI. When done right, dynamic pricing ensures high-demand equipment isn't underpriced (preventing money left on the table) and low-demand equipment isn't overpriced (preventing it from gathering dust in the yard). It also provides flexibility to remain competitive – you can respond to a competitor's rate change or a sudden market shift in real time. Overall, dynamic pricing helps align your rental income with actual market conditions, leading to higher revenue during peak times and better equipment turnover during lulls. Rental companies that embrace this strategy often see increased occupancy rates, more consistent cash flow, and a data-driven understanding of their business.

Short-Term vs. Long-Term Rental Pricing Strategies

Dynamic pricing can be applied to both short-term rentals (by the day or week) and long-term rentals (multi-month or annual contracts), but the tactics differ for each:

Short-Term Rentals: For short booking periods, dynamic pricing tends to be high-frequency and reactive. Rates can change daily or weekly based on immediate demand. For example, you might charge premium daily rates during a local construction boom or for last-minute orders when few units are available. In slower times or mid-week, you could lower day rates or offer weekend specials to spur demand. Short-term dynamic pricing often resembles yield management – similar to how a hotel might charge more on a busy weekend and less on a quiet Tuesday. The focus is on maximizing revenue per day and avoiding any equipment sitting idle. Tools like online pricing portals can display real-time daily rates, and your team can use flash deals or short-term discounts to fill gaps in the schedule. Just ensure that even when lowering prices, you cover your costs and maintain acceptable margins.

Long-Term Rentals: Longer rentals usually involve negotiated contracts and expectations of a stable rate, but you can still incorporate dynamic principles. One common approach is tiered duration pricing – for instance, a monthly rate that gets cheaper per day the longer the rental term (rewarding the commitment). However, you can make these tiers flexible based on market conditions. During peak demand season, you might tighten long-term discounts (since equipment is scarce, long commitments should pay closer to standard rates). In lean times, you can offer deeper discounts for long-term leases to secure guaranteed income. Another strategy for long hires is including usage-based clauses: for example, a fixed monthly fee that covers up to a certain number of machine hours, with an additional hourly charge for extra usage. This way, if the lessee uses the machine very intensively (higher wear and tear), you recoup more value. Conversely, if a long-term customer's project slows down (equipment sits idle on their site), you might proactively adjust their rate or provide a flexible pickup option so you can rent the machine to someone else – improving overall fleet utilization. Dynamic elements in long-term contracts could include periodic price reviews or indexation (tie rates to an index like equipment inflation or fuel costs) to ensure your pricing stays fair over a multi-year period. The key is balancing stability with flexibility: long-term clients get predictability and value, while you retain the ability to respond if market conditions dramatically change.

Tiered "Good-Better-Best" Pricing Frameworks

While dynamic pricing adjusts rates over time, you can also offer multiple pricing tiers at any given time to capture different customer segments. A popular framework is the "good-better-best" tiered model, which presents clients with options – typically a basic, mid-level, and premium package. This not only drives more revenue but also lets customers self-select based on their needs and budget. For heavy equipment rentals, tiered packages might look like:

Good (Basic Package): This is the no-frills option at the lowest rate. It could involve renting an older or lower-spec machine from your fleet with minimal add-ons. For example, a basic package for an excavator might include the machine rental alone, with the customer responsible for fuel and perhaps limited to standard working hours usage per day. This tier attracts price-sensitive customers or those with simple needs.

Better (Standard Package): The mid-tier offers more value or newer equipment for a moderate price. Here you might include a newer model machine or additional services. For instance, the standard package could bundle in maintenance support (on-call service if the machine breaks down) or an attachment (like a specific bucket or accessory) in the rental price. The daily/weekly rate is higher than Basic, but the customer gets a more efficient machine or extra convenience. This tier appeals to customers who seek a balance of cost and performance.

Best (Premium Package): This top tier commands the highest rate and targets customers who want maximum performance and support. A premium package might offer the latest model equipment (with the best fuel efficiency and features) plus a full service plan – e.g., delivery and pickup included, priority swapping of equipment if there's a breakdown, comprehensive insurance or damage waiver, and perhaps unlimited usage hours. Essentially, the customer pays extra for peace of mind and top-notch equipment uptime. This "white glove" rental option can significantly improve fleet ROI, as you justify a premium price with superior service and equipment quality.

Implementing a good-better-best structure allows you to segment your market. Small contractors or budget-conscious renters can opt for the basic tier, while larger clients with critical projects might gladly pay for premium reliability and service. By upselling customers to higher tiers when appropriate, you increase revenue per rental. It's important, however, to clearly define what each tier includes so customers see the value in paying more. Tiered pricing can also work hand-in-hand with dynamic pricing: each tier's base rate might fluctuate with demand. For example, in peak season your "Good" tier rates might rise closer to your normal "Better" prices, while in off-peak times, premium packages might be discounted to entice uptake. In all cases, ensure that even the lowest tier covers your costs and desired margin – and that higher tiers incorporate the added costs of the extra services or newer equipment provided.

Advanced Data-Driven Pricing Strategies

Beyond basic tiers and seasonal adjustments, rental companies can deploy more sophisticated pricing tactics to stay competitive. Advanced strategies leverage data and technology to fine-tune rates and even predict optimal prices. Here are some high-level strategies to consider:

Real-Time Demand Monitoring: Use software to monitor rental demand indicators (inquiries, booking rates, search trends on your website) and adjust prices on the fly. For instance, if inquiries for backhoe rentals double this month, your system could automatically nudge prices up for upcoming rentals of backhoes. Likewise, sudden drop in demand can trigger promotional discounts. Real-time monitoring ensures pricing always reflects the current market appetite.

Competitor Rate Analysis: Keep an eye on what nearby competitors are charging for similar equipment. Advanced pricing systems can integrate competitor price feeds or use web scraping to see market rates. If competitors run low on inventory and raise prices, you may have room to increase your rates slightly (still remaining a tad lower to attract customers). Conversely, if a competitor is undercutting prices in a slow market, you might offer matching rates or highlight extra value in your service. The goal is not to blindly copy competitors but to position your pricing smartly in the local market range. Geographic factors play a role too – prices might be higher in metro areas with lots of construction activity than in rural areas, so competitive analysis should be regional.

Dynamic Utilization-Based Pricing: This approach ties pricing directly to your fleet's utilization metrics. You define rules such as "when a category of equipment is over X% utilized, increase its rate by Y%" or "if an asset has been idle for Z days, apply a discount until it's rented." For example, if 90% of your skid steers are out on rent, the remaining 10% become more valuable – you might increase the rate on those because availability is scarce. On the flip side, if you have a particular excavator sitting unused for two weeks, a system could automatically apply a 15% discount to encourage someone to rent it. Utilization-based pricing ensures you maximize revenue on popular items and get under-used items moving by adjusting rates according to how busy your fleet is.

Predictive Pricing with AI: Larger companies are beginning to adopt artificial intelligence to forecast demand and set prices. AI models can analyze historical rental data, economic indicators, project pipelines, and even weather patterns to predict when demand will rise or fall. For example, an AI might learn that demand for generators and heaters increases a week before an expected cold wave, and suggest raising prices accordingly. It might also foresee slower demand in certain equipment due to an upcoming holiday lull and recommend lowering prices in advance to secure bookings. AI-driven pricing algorithms continuously learn and can optimize pricing at a granular level (potentially setting slightly different prices for each piece of equipment based on its age, location, etc.). While implementing AI requires good data and investment in software, it can yield very precise pricing that a human manager might miss, unlocking additional revenue or preventing losses. Even if you're not ready for full AI, you can start with simpler predictive analytics – for instance, using last year's rental trends to inform this year's price calendar.

Usage-Based Billing Models: Moving beyond traditional flat rental fees, consider offering pricing models where the cost correlates with actual usage. We touched on this for long-term contracts (e.g. a base rate plus hourly fees). In advanced form, you could offer pure pay-per-use rentals – where a customer pays a smaller fixed fee to have the machine and then a rate per hour of operation or per mile/kilometer if it's mobile equipment. This model is enabled by telematics (which we discuss next) and can be very attractive to customers who have uncertain usage needs. They effectively "share" some risk of low utilization with you; if they barely use the machine, they pay less. For the rental company, usage-based models ensure that if a customer works the machine hard, you earn more to cover the additional wear and tear. It's an advanced strategy that requires careful monitoring but can set you apart with a very fair pricing approach. One framework is "good-better-best" applied to usage – for example, one package might allow 8 hours of use per day, a higher-priced one allows 24/7 use, or charges are tiered by hour ranges. Usage-based pricing leverages technology and is a step toward performance-based rental agreements.

In implementing these advanced strategies, technology is your ally. Modern rental management systems can handle complex pricing rules, integrate multiple data sources, and even automate the price changes on your website or quotes. The sophistication you choose should match your business size and customer base – even simple dynamic rules can have a big impact. Start with a strategy that addresses your biggest pain point (be it too much idle inventory, highly seasonal demand swings, or aggressive competition) and build from there. The common thread in all advanced approaches is being data-driven: decisions on pricing should come from objective metrics and analytics rather than gut feel alone.

Leveraging Telematics Data for Smarter Pricing

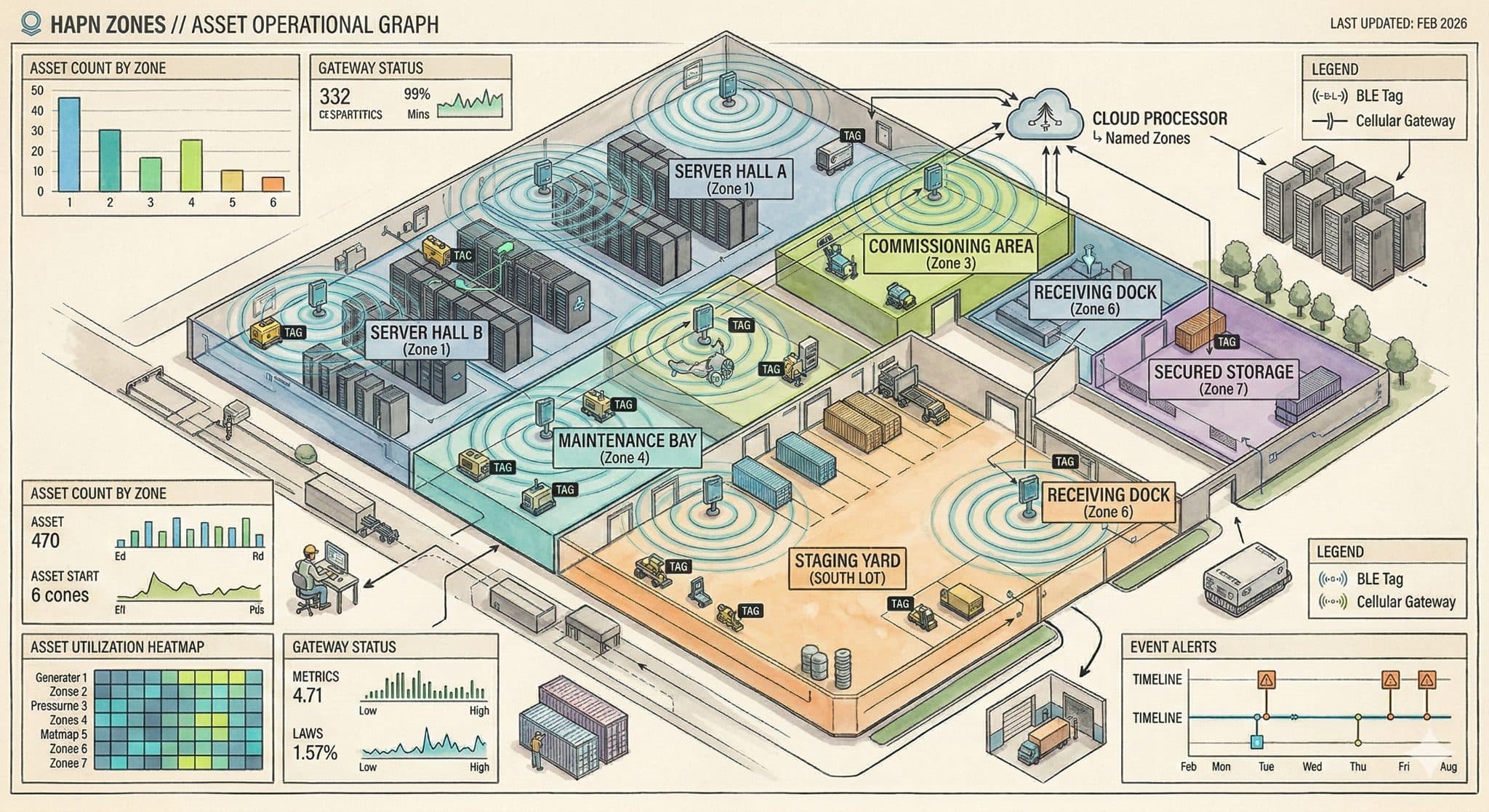

One of the richest data sources for dynamic pricing in equipment rental is your fleet's telematics and IoT data. Most modern heavy machines come equipped with telematics devices that record usage details, GPS location, idle time, and more. By tapping into this information, rental owners can make highly informed pricing decisions. Here are key telematics-driven data points and how they can inform your pricing model:

Telematic systems track equipment in the field – from location to usage hours. In the photo above, a compact loader at a secured site is marked with a GPS locator. Such real-time data allows rental companies to see how and where their machines are being used (or if they're sitting idle) and adjust pricing or relocation decisions accordingly.

Utilization Rates: Telematics provides exact data on how many hours a machine is running versus how long it's rented out. If a particular excavator in your fleet consistently shows very high utilization (e.g., it's operating close to 8-10 hours every rented day), that indicates strong demand and possibly wear. You might respond by raising the rental rate for that model or unit, knowing customers find it valuable (and to compensate for the heavy usage). On the other hand, if telematics reveals that another machine is only being used 2 hours per day on average, you might lower the rate or restructure the deal to encourage more usage (or rent it to someone who will use it fully). Utilization data helps ensure you charge according to the actual value customers get from the equipment – high utilization can justify a premium price, while low utilization might signal an overpriced or oversupplied item that needs a price cut. To better understand your overall fleet metrics and identify trends across multiple locations, see our guide on new telematics alerts for OBD-II devices, which can help you monitor equipment performance in real time and trigger pricing adjustments automatically.

Idle Time and Idle Units: You can track when and how long equipment stays idle (engine off) during a rental or on your yard. If a unit has been idle on your lot for a long stretch, that's a candidate for a dynamic discount or promotion. Even during a rental, if the machine's idle hours are extremely high (meaning the renter isn't actually using it much), it might indicate an opportunity: perhaps the customer rented a too-large machine or their project paused. While you wouldn't typically adjust a rate mid-contract without prior arrangement, such insights could guide future pricing or sales approaches (e.g., offer them a smaller machine at lower cost next time). Fleet-wide, identifying idle equipment clusters allows you to temporarily drop prices on those to get them moving. Some rental companies even send alerts to the sales team when a piece of gear hasn't rented in X days, prompting them to market it at a special rate. Minimizing idle inventory through pricing incentives is a direct way telematics data adds value.

Location-Based Demand: GPS data from telematics shows where your machines currently are. Coupled with rental records, you can map demand hotspots. For instance, you may find your aerial lifts are mostly working on sites in a particular city area that's booming with construction. Knowing this, you could implement zone-based dynamic pricing – higher rates in high-demand urban cores versus lower rates for the same equipment in outlying areas. Location data also helps with logistics costs: if you see a machine is located far from your depot and a new rental comes from that far region, you might include a higher delivery fee or dynamic surcharge for the extra transport (or conversely, give a discount if the machine is conveniently already near the customer's site). Additionally, if one region's telematics reports show all equipment busy while another region has units free, you face a decision: either relocate assets or adjust prices regionally. Sometimes it's faster to tweak pricing than to move machines – e.g., raise prices in the busy region to manage demand and drop them in the slow region to stimulate it. In summary, telematics location data enables geo-intelligent pricing, ensuring your rates consider where the equipment is and the local demand intensity there.

Demand Trends & Predictive Insights: Over time, telematics builds a historical record of usage patterns. By analyzing this data, you can spot trends like seasonal spikes for certain equipment (e.g., paving equipment usage peaks in summer) or daily usage patterns (perhaps lighting towers run more often in winter months, or generators during storm seasons). These trends inform predictive dynamic pricing – you can preemptively adjust rates ahead of a forecasted demand increase rather than reacting after you're fully booked. For example, if last year your telematics showed a jump in forklift operating hours every December (maybe due to holiday season warehousing), you can plan to raise forklift rental rates as November ends, in anticipation of the rush. Conversely, telematics might reveal consistently low utilization of certain equipment in winter, prompting you to introduce winter-rate discounts to attract renters during those months. By grounding your pricing adjustments in solid data trends, you not only optimize revenue but also build credibility with customers (you can explain that prices are lower when demand is historically lower, and higher when everyone needs the equipment). Telematics data combined with external data (like project permits or economic indicators) can even feed into machine learning models for highly refined pricing strategies, as discussed earlier.

Maintenance and Wear Data: While not explicitly about pricing, telematics often provides insight into machine health, engine hours, and maintenance needs. This can influence pricing indirectly. For instance, if a particular unit is nearing a major service interval or has many hours on it, you might decide to offer it at a slightly lower rate to make sure it stays rented until you schedule maintenance (maximizing income up to the service) – customers may be price-sensitive to older equipment, so a discount keeps it competitive. Alternatively, you might factor in a "wear fee" for extremely heavy usage scenarios: e.g., if telematics shows that a customer consistently pushes a machine to its limits (high engine loads, very long daily operation), you ensure your pricing or contract terms cover the extra wear (perhaps via a usage surcharge or a clause that triggers maintenance fees beyond X hours used). In short, telematics helps tailor pricing not just to demand but also to the condition and performance of each asset, ensuring you recover costs appropriately.

Incorporating telematics data into pricing decisions transforms dynamic pricing from a blunt instrument into a precise scalpel. You're no longer guessing which equipment to discount or when to raise rates – the data guides you. For rental owners, this means more confidence in pricing changes and an ability to explain those changes. For example, you can tell a customer, "Our rates for that loader are a bit higher this month because nearly our entire fleet of loaders was utilized 90%+ last month – demand is extremely high." Or, "I can give you a special rate on this bulldozer model, since we have a few currently available that haven't been rented recently." This level of transparency (backed by data) can improve customer acceptance of dynamic pricing, making it feel fair rather than arbitrary.

Building a Responsive Rate Structure

With various pricing strategies and data inputs at your disposal, the challenge is to build a cohesive rate structure that is both flexible and easy to manage. In practice, this means combining baseline pricing frameworks with dynamic adjustments, and having processes in place to review and update rates regularly. Here's how you can construct a responsive pricing structure for your rental business:

1. Establish Base Rates and Tiers: Start with a solid foundation – your base rental rates for each piece of equipment under normal conditions. These might be derived from cost-plus calculations (covering ownership cost, depreciation, maintenance, overhead, and target profit). Also set up any tiered rates for different rental durations (daily, weekly, monthly) and tiered service levels (as in good/better/best packages). Think of these as your "rack rates" or list prices. They provide structure and predictability as a reference point. Ensure these base rates are profitable on their own before any discounts; dynamic pricing will then adjust around a healthy baseline.

2. Define Dynamic Rules for Demand and Availability: Next, overlay dynamic pricing rules that respond to market conditions. For example, create rules such as: "If fleet availability for an equipment category falls below 20%, increase its rental rate by 10%" or "If a piece of equipment has been idle >30 days, enable a 15% discount promotion on it." Define seasonal adjustments in your rate structure as well – perhaps an automatic +20% price bump for snow removal equipment every January and a corresponding off-season discount in summer. These rules can be implemented in your rental software or even manually tracked on a spreadsheet, but they should be clear and consistent. By formalizing them, you ensure your team isn't adjusting prices ad-hoc; instead, you have a policy-driven approach where price changes are triggered by measurable conditions (inventory levels, date ranges, etc.). This makes it easier to explain and justify pricing to both staff and customers.

3. Incorporate Usage Intensity Considerations: Decide how you'll handle variations in equipment usage intensity. If you opt for usage-based billing (e.g., charging extra per hour beyond a threshold), bake that into your rate structure and contracts. Alternatively, set different rates for "standard use" vs "heavy use" scenarios – for instance, a higher rate (or additional fees) for a machine going into harsh environments or 24/7 operations. Some rental companies have premium rates for extreme usage such as around-the-clock operation, because the wear and risk are higher. Make sure these nuances are codified. Your structure might include an "excess hours" charge or a requirement that long-term rentals report hours via telematics so you can bill overages. Having a plan for usage intensity keeps your pricing responsive not just to whether the equipment is rented, but how it's being used.

4. Leverage Technology for Automation: A responsive pricing strategy can become complex – that's where software can help. Utilize your rental management system's features or a specialized pricing tool to automate as much as possible. For example, set up your system to automatically apply weekend rates, or to generate alerts when certain conditions (like low stock or long idle time) are met so you know it's time to adjust a price. Some systems will let you publish dynamic pricing on your website in real-time, so customers always see up-to-date rates. The goal is to reduce manual effort and ensure pricing rules are applied consistently and quickly. Automation also cuts down on errors (like forgetting to end a promotional discount, or mispricing an asset in a busy period). When evaluating software, look for features like competitor rate tracking, rule-based price engines, and integration with telematics for usage data. While you want to remain vendor-neutral, investing in a pricing module or business intelligence tool that plugs into your fleet data can pay for itself through optimized rates.

5. Regularly Review and Refine: Building a responsive structure isn't a one-and-done task – it requires continuous tuning. Assign responsibility to someone on your team (or yourself, if you're the owner) to review pricing performance regularly. This could be a quick monthly analysis of key metrics: utilization rates by equipment type, revenue per day per asset, lost rentals (times when customers walked away due to price or lack of availability), etc. Use these insights to refine your rate structure. For example, you might discover your weekly rate discount is too generous if weekly rentals are very high while daily rentals slump – perhaps adjust that tier. Or maybe your dynamic surge of +10% in peak season isn't deterring enough demand and you are fully booked out early – next year you might surge +15% and see if revenue improves without hurting utilization. Quarterly, take a deeper dive: look at seasonal patterns, customer feedback on pricing, and profitability by segment. And at least annually, review the entire strategy: Are your base rates still aligned with costs and market value? Do your dynamic rules need tweaking? Is your software or process adequate for current volume? This iterative approach ensures your pricing stays agile and effective over time. A good habit is to document these reviews – keep a log of pricing changes you made and the outcome, which will help inform future decisions.

6. Balance Simplicity with Flexibility: While we encourage responsive and nuanced pricing, be careful not to overcomplicate. Customers (and your sales staff) should still find your pricing understandable and fair. If you have too many surcharges and exceptions, it can frustrate customers or lead to invoicing mistakes. Strive for a structure where about 80% of scenarios are covered by clear, standard pricing, and only 20% require special handling. You might consolidate some factors – for example, instead of separate surcharges for everything (fuel, wear, delivery distance, etc.), perhaps roll typical costs into the main rate except in truly unusual circumstances. The idea is to be flexible without being chaotic. A well-structured rate system will make use of dynamic pricing but present it to customers in a digestible way (e.g., "High Season Rate" vs "Standard Rate" rather than a cryptic algorithm). Internally, provide your team with cheat sheets or a dashboard that shows current rates and any active adjustments so everyone stays on the same page.

By building a responsive rate structure in this manner, you effectively create a living pricing strategy that moves with your business environment. You'll be able to respond to a sudden surge in equipment demand or a supply chain issue that limits new machines, all without panicking – your framework will guide the decisions. The outcome is typically higher overall utilization and profitability, with fewer instances of "gut feeling" pricing. And remember, implementing dynamic pricing is a journey; start with a few core elements and gradually layer on more sophistication as you become comfortable and as your data capabilities grow.

Communicating Dynamic Pricing to Customers

Introducing dynamic pricing to your customers requires a thoughtful approach to maintain trust and avoid confusion. Transparency and communication are paramount – you want your clients to understand why prices may vary and how it benefits them, not just the rental company. Here are some best practices for rolling out and managing dynamic pricing from a customer-relations perspective:

Be Transparent in Contracts and Quotes: Clearly outline your pricing terms in rental agreements. If rates are subject to change due to season or availability, state that upfront (e.g., "Rental rates are valid for 30 days and may adjust based on equipment availability or seasonal demand"). For long-term contracts, consider clauses that explain any scheduled rate escalations or review periods. The more a customer knows in advance, the less likely they'll be surprised or upset by a price change. On quotes or invoices, you can also itemize any dynamic adjustments – for instance, show the base rate and then a line "Off-peak discount applied" or "High-demand period surcharge" so they see it's part of a structured policy, not an arbitrary number.

Use Digital Portals for Real-Time Rates: If you have an online rental portal or app, make use of it to communicate dynamic prices. Customers should be able to see current rates for equipment and know that those rates might update periodically. You might include a note like "Save 10% by booking now – price may increase later as availability changes." Some rental companies have interactive calendars on their website where customers can view how prices fluctuate on different dates (similar to airline booking sites). Providing this information empowers customers to make informed decisions – for example, they might shift their rental start date slightly to get a better rate if their schedule allows. A digital portal can also highlight special deals (e.g., "This excavator is 15% off this week!"), turning dynamic pricing into a marketing advantage. Learn more about leveraging fleet utilization benchmarks to optimize your rates.

Leverage CRM for Personalized Communication: Your customer relationship management (CRM) system is a great tool to help with pricing communication. Keep records of each customer's rental history and sensitivity to price. For your loyal or repeat clients, you may want to proactively reach out when dynamic pricing works in their favor – "Hi, we wanted to let you know our off-season rates on bulldozers are now in effect, which is a great opportunity for the project you mentioned next month." Conversely, if you know a customer rents the same equipment every summer, an account manager can warn them in spring: "This coming summer we anticipate high demand for aerial lifts. It's best to reserve early; prices may rise as we enter peak season." Such communication turns dynamic pricing into a value-add service ("we're giving you a heads up") rather than a pain point. Additionally, CRM data can help you tailor promotions – for instance, offering a discount to a customer who frequently rents an item that's currently underutilized.

Train Your Sales and Customer Service Team: Your team should be well-versed in explaining dynamic pricing to customers. Equip them with simple talking points about why prices change. For example: "Our pricing works a lot like airline tickets – when there's a lot of demand for a particular machine, the price goes up a bit, and when things are slower we can offer lower rates. This helps us ensure equipment availability and reward customers who rent during off-peak times." Also train them to highlight the customer benefits of dynamic pricing: if a customer is booking far in advance or during a quiet period, congratulate them on securing a great rate. If a customer is hit with a higher price due to late booking or peak season, your team can justify it by noting how availability is limited and the equipment will be ready for them when needed. Emphasize service and value at all times – dynamic pricing should never be an excuse for poor service; in fact, when customers pay peak rates, that's when you want to over-deliver on support to reinforce that they're getting what they pay for.

Implement Fairness Policies: To maintain goodwill, consider policies that prevent negative customer experiences. For example, if a customer already has a quote or reservation and your dynamic pricing algorithm wants to raise the price afterward, it's wise (and fair) to honor the original quoted price for a reasonable period. Sudden changes without notice can breed resentment. Similarly, avoid gouging – set maximum caps for surcharges so prices don't jump excessively high in extreme demand (unless the market truly dictates it). Some companies institute a "price protection period" for long-term renters, assuring them that their rate won't change for the duration of their contract or that they'll be given notice and an option to agree on any adjustments. These gestures show customers that dynamic pricing isn't about nickel-and-diming them, but about a responsive strategy that overall can benefit both parties.

Highlight Savings and Options: Whenever possible, frame dynamic pricing positively. If a customer got a discount, point it out ("You saved $500 by renting in the winter – our rates are lower in the off-season!"). If your structure offers alternatives, make them clear: "The rate is higher for a 1-day rental, but if you can use it for 3 days, our multi-day rate will actually save you money." This not only helps the customer feel in control but can also encourage them to extend rentals or try different options that increase your revenue. In effect, dynamic pricing can be a consultative sales tool – you're guiding the customer to the best value solution for their situation. For more insights, check out our guide on total cost of ownership (TCO) for equipment rental.

In summary, communication is the cushion that softens the impact of dynamic pricing changes. By being upfront and customer-centric, you can implement sophisticated pricing strategies without alienating your clientele. Many customers will accept flexible pricing if they understand the rationale and see some benefit for themselves. Over time, as dynamic pricing becomes the norm in the industry, transparent communication will also become a competitive differentiator – companies that communicate well will earn a reputation for honesty and partnership, whereas those that change prices opaquely might struggle with customer loyalty.

See How Hapn Works for Your Fleet

Get a personalized walkthrough and transparent pricing — no commitment required.

Get Pricing →Conclusion

Dynamic pricing, when executed thoughtfully, is a game-changer for heavy equipment rental businesses. It enables owners to maximize fleet ROI, improve utilization, and stay competitive in a fluctuating market. By combining practical frameworks (like tiered packages and duration-based rates) with advanced data-driven tactics (real-time demand tracking, telematics insights, and predictive adjustments), rental companies can build a pricing strategy that moves in lockstep with demand and usage patterns.

The journey to dynamic pricing excellence involves careful planning, the right tools, and continuous learning. Start with a solid foundation of costs and value, then layer on dynamic rules as your confidence grows. Use your telematics and market data – these are gold mines for refining prices – and don't shy away from investing in software automation when it makes sense. Equally important, bring your customers along on this journey: communicate openly, offer options, and ensure that your pricing changes make sense to them as well as to your bottom line.

By adopting the strategies outlined above, heavy equipment rental owners can transform pricing from a static administrative task into a strategic lever for growth. You'll be able to respond to a hot market with higher earnings, entice customers during slow times, and allocate your fleet more efficiently across projects. In an industry where profit margins and customer relationships are always on the line, a dynamic pricing model – executed with authority and accessibility – can deliver improved profitability, better customer satisfaction, and a strong competitive advantage. It's about renting smarter, not just harder, and positioning your company as a forward-thinking leader in the rental space. Here's to a more profitable and responsive future for your rental fleet!

Written by the Hapn Team — Hapn provides full-stack fleet and asset telematics for construction, rental, and field service companies. Learn more →

Frequently Asked Questions

What is the main benefit of dynamic pricing for equipment rental companies?

The primary benefit is improved fleet utilization and ROI. Dynamic pricing ensures high-demand equipment commands premium rates and low-demand equipment gets discounted to keep it moving. This leads to higher overall revenue, better equipment turnover, and a more data-driven understanding of your business.

How does telematics data improve pricing decisions?

Telematics provides real-time insights into utilization rates, idle time, location, and usage patterns. This data allows you to implement geo-intelligent pricing, create utilization-based rate adjustments, predict demand trends, and tailor pricing to actual machine condition and performance – transforming pricing from guesswork into precision.

What is a "good-better-best" pricing framework and why should rental companies use it?

This tiered model offers basic, mid-level, and premium packages at the same time, allowing customers to self-select based on their needs and budget. It helps segment your market, increases revenue per rental through upselling, and works hand-in-hand with dynamic pricing to capture value from different customer segments.

How should rental companies communicate dynamic pricing to customers?

Communication should emphasize transparency and fairness. Be upfront about pricing terms in contracts, use digital portals to show rate changes in real-time, train your sales team with simple explanations (compare it to airline pricing), honor previous quotes for reasonable periods, and highlight how dynamic pricing can benefit customers who book off-peak or in advance.

Can small rental companies implement dynamic pricing, or is it only for large enterprises?

Dynamic pricing scales from simple to sophisticated. Small companies can start with basic seasonal adjustments or utilization-based discounts without advanced software. As you grow and invest in rental management systems, you can layer on more sophisticated strategies. The key is starting with your biggest pain point and building from there.

Ready to Take Control of Your Fleet?

Join hundreds of construction and rental companies tracking smarter with Hapn.

Get Your Custom Quote →