Last updated: February 2026

The best GPS tracker for construction equipment depends on what you're tracking (powered heavy equipment vs. unpowered assets), how deep you need the data to go (location-only vs. full telematics), and whether you need to track a mixed fleet of vehicles and equipment on one platform. For most construction companies, Hapn's equipment tracking solution offers the strongest combination of hardware flexibility, telematics depth, ease of use, and transparent pricing — particularly for mixed fleets that include both powered and battery-tracked assets.

We evaluated nine GPS tracking platforms based on hardware variety, software features, construction-specific capabilities, contract terms, pricing transparency, and customer support. Here's how they stack up in 2026.

Key Takeaways

- Construction equipment theft costs the U.S. industry over $1 billion annually, with less than 25% of stolen assets ever recovered — making GPS tracking essential, not optional.

- The best construction GPS trackers connect directly to equipment power sources to report engine hours, ignition status, and diagnostic data — not just location.

- Hapn monitors 463,000+ assets across 50+ industries with 99.9% uptime and offers transparent, no-contract pricing — unlike competitors like Samsara and Verizon Connect that require multi-year agreements.

- For mixed fleets (vehicles + heavy equipment + unpowered assets), you need a platform with both hardwired and battery-powered device options — not all providers offer both.

- Construction companies that implement GPS tracking typically see a 15-20% improvement in equipment utilization and recover the cost of the system within 30-90 days.

How to Choose a GPS Tracker for Construction Equipment

Before comparing specific providers, you need to understand the key decisions that will narrow your options. The wrong choice here costs you more than money — it costs you months of implementation time and the political capital you spent getting approval for the investment in the first place.

What is a Mixed Fleet?

A mixed fleet is any operation that manages a combination of on-road vehicles (trucks, service vans), powered heavy equipment (excavators, dozers, loaders), and unpowered assets (trailers, generators, tool containers). Most construction companies operate mixed fleets. The challenge is finding one tracking platform that handles all three asset types with appropriate hardware for each.

Powered vs. unpowered equipment is the first and most important distinction. Powered equipment (excavators, dozers, skid steers) can support a hardwired tracker that draws power from the machine's electrical system, captures engine hours and diagnostic data via the ignition wire or CAN bus, and never needs a battery change. Unpowered assets (trailers, containers, generators when off) require battery-powered trackers, where battery life, weather-resistance rating (look for IP67 or IP68), and update frequency trade-offs become critical. As we covered in our guide on what fleet managers get wrong about mixed fleets, trying to force one device type across all your assets is the most common (and costly) mistake.

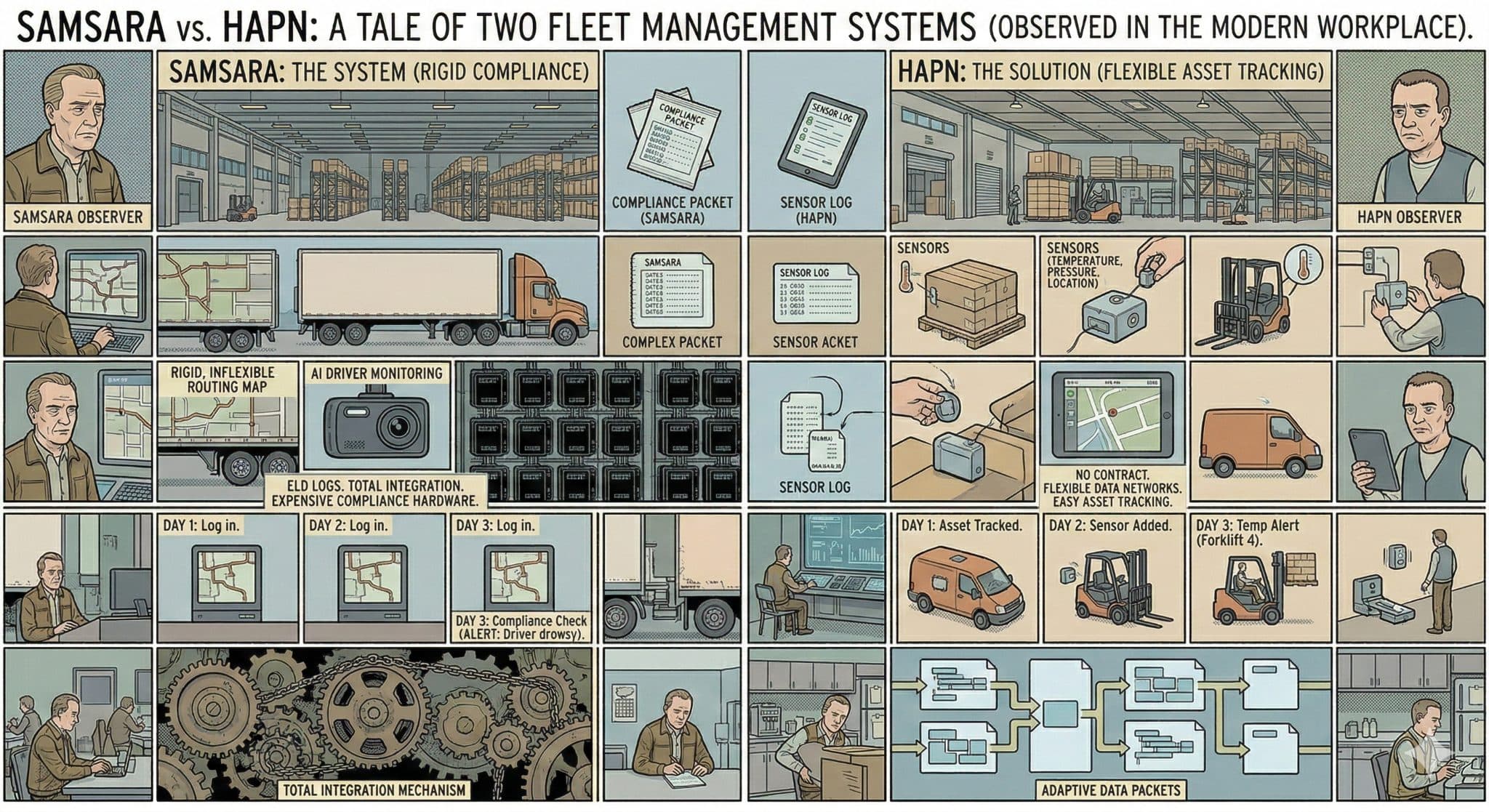

Software depth vs. simplicity is the second major trade-off. Enterprise platforms like Samsara and Motive pack hundreds of features — driver scorecards, compliance logging, AI dashcams, fuel card integration — that are essential for trucking fleets but often irrelevant (and confusing) for a construction company that primarily needs to know where equipment is, how many hours it's running, and when it needs maintenance. Conversely, platforms that are too simple won't give you the telematics data you need for usage-based billing or preventive maintenance scheduling.

Contract terms and pricing transparency matter more than most buyers realize upfront. Several major providers lock you into 3-5 year contracts with pricing that only appears after a sales call. If you're scaling a fleet or testing GPS tracking for the first time, you want the flexibility to add or remove devices without penalty.

The 9 Best GPS Trackers for Construction Equipment in 2026

| Provider | Best For | Hardware Options | Contract Required? |

|---|---|---|---|

| Hapn | Mixed fleets (equipment + vehicles + assets) | Hardwired, battery, OBD, dash cam | No — month-to-month |

| Samsara | Large enterprise fleets with heavy compliance needs | Vehicle gateway, asset tracker, cameras | Yes — typically 3 years |

| Motive | Safety-focused fleets with driver management needs | Vehicle gateway, asset gateway, AI dashcam | Monthly options available |

| Verizon Connect | Companies already in the Verizon ecosystem | Vehicle tracker, asset tracker, cameras | Yes — typically 3 years |

| DPL Telematics | Long battery life & rugged field deployments | AssetView, AssetCommand, OBD, satellite | Pay-as-you-go available |

| Tenna | Large construction companies needing maintenance integration | GPS, Bluetooth beacons, QR tags | Contact for pricing |

| Geoforce | Remote sites needing satellite coverage | Cellular, satellite, hybrid | Contact for pricing |

| Geotab | Vehicle-heavy fleets with data/integration needs | OBD, vehicle trackers | Through resellers |

| Trackunit | Enterprise construction with deep CAN bus needs | Hardwired, telematics gateways | Contact for pricing |

1. Hapn — Best Overall for Construction Mixed Fleets

Hapn offers the broadest range of rugged tracking hardware at competitive, transparent prices, paired with a powerful yet intuitive platform that doesn't require weeks of training. With 50,000+ customers across 50+ industries and 463,000+ assets on the platform, Hapn has the scale and reliability that construction operations demand.

For powered equipment, Hapn's hardwired trackers connect to the machine's ignition wire or CAN bus to capture engine hours, runtime, fault codes, and location data in real time. For unpowered assets like trailers, generators, and tool containers, their battery-powered trackers offer IP67-rated weather resistance with battery life measured in months to years depending on update frequency — and you can adjust that frequency over the air without physically touching the device.

What sets Hapn apart for construction companies specifically is the combination of depth and simplicity. You get full telematics including engine diagnostics and fault code data, usage reports, geofence alerts, theft recovery capabilities, and maintenance data without the bloat of fleet compliance features you'll never use. The platform processes over 4 billion messages annually with 99.9% uptime, and the customer support team consistently earns top ratings (4.8/5 across 11,300+ reviews).

Why construction companies choose Hapn: No contracts, no hidden fees, transparent pricing visible on the website. Install devices yourself in minutes or use Hapn's installation support for larger deployments. The open API integrates with ERP and rental management systems. Plus, both vehicle tracking and equipment tracking run on the same platform — one dashboard for your entire mixed fleet.

Limitations: Hapn does not currently offer satellite tracking devices, which matters only for extremely remote sites without cellular coverage.

See Why 50,000+ Customers Choose Hapn

Track your entire construction fleet — vehicles, equipment, and assets — in one platform. No contracts, transparent pricing, 99.9% uptime.

Get Pricing →2. Samsara

Samsara is one of the largest fleet management platforms on the market, and their software has a clean, modern interface with extensive reporting capabilities. Their strength is in vehicle fleet management: ELD compliance, route optimization, driver scorecards, and AI-powered dash cameras are all best-in-class. For construction companies that also manage a large over-the-road fleet, Samsara's breadth is a genuine advantage.

However, Samsara's focus is squarely on vehicles and drivers, not equipment. Their hardware selection for construction equipment tracking is limited compared to dedicated equipment platforms. The software's sheer volume of features — while impressive for fleet managers — can overwhelm construction teams that need straightforward equipment location and usage data.

Strengths: Polished UI and mobile apps, strong dashcam and driver safety features, extensive integrations with 200+ third-party platforms, well-engineered hardware with good reliability.

Weaknesses: Typically requires 3-year contracts with limited early termination flexibility. Pricing is not publicly available and tends to be at the premium end of the market. The feature set is vehicle-centric, and the equipment tracking experience is secondary. For a deeper comparison, see our heavy equipment GPS tracker comparison.

3. Motive (formerly KeepTruckin)

Motive has rapidly grown to serve over 120,000 customers across industries including construction, energy, and transportation. Their platform is built around an "integrated operations" approach that combines GPS tracking, AI dashcams, ELD compliance, spend management (via their fleet fuel card), and equipment monitoring in a single system. Motive serves companies like Halliburton and Komatsu, signaling serious enterprise capability.

For construction companies, Motive's Asset Gateway and Asset Gateway Mini provide real-time GPS tracking for equipment and unpowered assets. The Asset Gateway Mini is battery-powered with a 5-year battery life (on two daily check-ins), making it a viable option for trailers and containers. Motive's Vehicle Gateway handles on-road fleet tracking with strong telematics depth, and their AI Omnicam provides surround-view camera coverage that's particularly useful on congested construction sites.

Strengths: Industry-leading 1-3 second GPS refresh rate for vehicles. Strong AI safety features with a dedicated team of 400+ safety experts reviewing dashcam footage. 240+ third-party integrations including John Deere, Komatsu, CAT, and Volvo Construction. Monthly contract options available (more flexible than Samsara). Highly rated apps (4.5/5 on both iOS and Capterra).

Weaknesses: The platform's breadth — fleet, safety, spend, compliance — can be overkill for construction companies that primarily need equipment tracking. Multiple G2 and BBB reviews cite billing issues and slow customer service resolution. Pricing is not publicly available. Equipment tracking features, while improving, are not as mature as their vehicle fleet capabilities.

4. Verizon Connect

Verizon Connect benefits from Verizon's extensive cellular network, which provides strong coverage in areas where smaller carriers may have gaps. The platform offers GPS tracking with supplementary data like temperature changes, vibration levels, and door movement — useful for specialty construction equipment and material trailers. Geofencing and after-hours movement alerts are standard.

Strengths: Excellent network coverage via Verizon's infrastructure. Good breadth of data inputs beyond basic location. Each customer is assigned a designated contact for support.

Weaknesses: Like Samsara, Verizon Connect's core focus is vehicle fleet management, not construction equipment. Hardware options for heavy equipment are limited. Multiple online reviews cite reliability issues with hardware and a platform that can feel dated compared to newer competitors. Requires multi-year contracts (typically 3 years) with pricing available only through sales consultation.

5. DPL Telematics

DPL Telematics has over 20 years of experience in asset monitoring, with particular strength in construction, mining, oil and gas, and rail industries. They've earned trust managing over $1 billion in customer mobile assets. Their product line is specifically designed for the realities of construction and industrial environments, not adapted from a fleet management platform.

DPL's AssetView line of battery-powered trackers stands out for harsh-environment deployments. IP68-certified and powered by standard (non-proprietary) batteries, the AssetView devices feature DPL's proprietary "TruTrace Adaptive Tracking" technology — an accelerometer-GPS combination that intelligently adjusts update frequency based on whether the asset is moving, optimizing battery life without sacrificing visibility. Their newer AssetView Shadow combines GPS, Wi-Fi, and cell tower positioning for tracking assets both indoors and outdoors, with an embedded Bluetooth 5.2 gateway for sensing tagged smaller assets. Battery life ranges up to 10 years on daily updates.

For powered equipment, the AssetCommand line and Trackall OBD II devices provide hardwired telematics with ignition monitoring, fault code reading, and anti-tamper protection (backup battery that sends immediate disconnection alerts).

Strengths: Purpose-built for heavy industry, not adapted from a vehicle fleet product. Extremely ruggedized hardware (IP68, IK07 rated). Pay-as-you-go subscription model — you only pay when the device is actively in service. Standard, non-proprietary batteries mean no vendor lock-in on replacements. Indoor/outdoor tracking capability with the Shadow device.

Weaknesses: Software interface is functional but not as modern or polished as platforms like Samsara or Hapn. The company is smaller, so the integration ecosystem and API capabilities are less extensive. Customer-facing materials and online presence could be stronger, which may make it harder to evaluate before buying.

6. Tenna

Tenna was founded by people in the construction industry, and that DNA shows in their product. The platform is designed specifically for construction operations and doesn't include the extraneous fleet compliance features found in generalist platforms. Their hardware range is notably broad — GPS trackers, Bluetooth beacons, QR code tags — allowing you to tiered-track everything from a $500,000 excavator down to a $200 cut-off saw.

Tenna's maintenance management features are particularly strong, offering scheduled maintenance tracking integrated directly with equipment usage data. For large construction companies that need a unified asset management and maintenance platform, Tenna is a serious contender.

Strengths: Built by and for construction. Broad hardware ecosystem including low-cost Bluetooth and QR options for small tools. Strong maintenance scheduling and integration features. Excellent customer support reputation.

Weaknesses: Premium pricing that may be difficult to justify for small and mid-sized construction operations. The maintenance module is required as part of the package, which adds cost for companies that already have maintenance software. The depth of features can feel like overkill for operators who just need location and basic usage data.

7. Geoforce

Geoforce's differentiator is satellite tracking. While most GPS platforms on this list rely exclusively on cellular networks to transmit data, Geoforce offers robust satellite-based hardware that works in locations with zero cellular coverage. For construction companies operating in truly remote environments — pipeline projects, rural energy infrastructure, mining sites — this capability is non-negotiable.

Geoforce got its start in the oil and gas industry and has expanded into construction, rental, and mining. Their platform is straightforward and easy to use, though it lacks the feature depth of more modern competitors.

Strengths: Satellite tracking hardware that works anywhere on Earth. Strong presence in oil, gas, and mining where remote coverage is critical. Simple, easy-to-learn software interface.

Weaknesses: Software has not kept pace with modern UI expectations and needs an update. Key features like over-the-air tracker configuration changes aren't available. Reporting is limited and not very flexible. Satellite connectivity comes at a higher cost per device than cellular-only alternatives.

8. Geotab

Geotab is one of the largest and oldest telematics providers globally, with millions of connected vehicles. Their strength is in data — Geotab's platform captures an enormous amount of vehicle performance data, and their Marketplace offers hundreds of add-on integrations and applications from third-party developers. For vehicle-heavy construction fleets (dump trucks, concrete mixers, service vehicles), Geotab's depth of fleet analytics is hard to beat.

Strengths: Massive integration ecosystem through the Geotab Marketplace. Excellent vehicle diagnostics, fuel management, and driver behavior analytics. Very reliable technology and large-scale infrastructure. Strong data and reporting capabilities.

Weaknesses: Geotab is a vehicle tracking platform — it does not offer dedicated hardware for tracking heavy construction equipment or unpowered assets. You cannot purchase directly from Geotab; all sales go through authorized resellers, which adds a layer of complexity to purchasing, support, and pricing.

9. Trackunit

Trackunit is purpose-built for the construction industry and focuses on equipment telematics. The platform reads CAN bus data from heavy equipment OEMs, providing visibility into engine fault codes, machine health, fuel consumption, and operational patterns beyond basic location and hours tracking.

For large construction companies managing fleets of Caterpillar, John Deere, Komatsu, and other major OEM equipment, Trackunit's construction-specific focus is relevant. Their software is well designed, particularly for equipment maintenance workflows.

Strengths: CAN bus telematics data from major equipment OEMs. Purpose-built for construction — not a vehicle platform adapted to equipment. Wide variety of hardware for different equipment types. Strong maintenance and machine health features.

Weaknesses: The volume of telematics data (especially error codes) generates numerous alerts that can overwhelm operators and create alert fatigue. Premium pricing makes it difficult to justify for small and mid-sized operations. Trackunit focuses on large enterprise construction businesses and may not prioritize smaller accounts. Adding vehicles and non-construction assets to the same platform is limited compared to mixed-fleet platforms like Hapn, meaning you may need a second system for your trucks and service vehicles.

What Construction Companies Actually Need from a GPS Tracker

After evaluating all nine platforms, the core requirements for construction equipment tracking come down to five capabilities that matter most in daily operations.

Real-time location with geofencing is table stakes — every platform on this list offers it. The difference is in how quickly you can set up geofences and how reliably alerts fire. For construction operations managing equipment across multiple job sites, after-hours movement alerts are your first line of defense against theft. According to the National Equipment Register, construction equipment theft exceeds $1 billion annually, with recovery rates below 25%.

Engine hour tracking is what separates basic GPS from true equipment management. If you're renting equipment, engine hours drive your billing — as we covered in our guide on telematics-based overage billing. If you own your fleet, engine hours drive your maintenance scheduling. According to industry benchmarks, engine hour-based maintenance reduces unplanned downtime by up to 30% compared to calendar-based scheduling.

Mixed fleet support means having appropriate hardware for every asset type — hardwired devices for powered equipment, long-life battery trackers for unpowered assets, and OBD or vehicle telematics for trucks and service vehicles. If your provider only does vehicles, or only does equipment, you end up running two platforms and doubling your administrative overhead.

Utilization reporting tells you which assets are earning their keep and which are sitting idle. The average equipment rental company sees 12-18% idle inventory at any given time. Even owned-fleet construction companies often discover through tracking data that they have underutilized assets that could be redeployed, rented out, or sold.

Integration capability becomes critical as your operation scales. Whether you need to feed data into Point of Rental, Wynne, Salesforce, or a custom ERP, an open API determines whether your tracking data stays siloed in a dashboard or becomes part of your operational workflow.

Final Verdict

For most construction companies — particularly those managing a mix of vehicles, powered equipment, and unpowered assets — Hapn offers the best combination of hardware flexibility, telematics depth, transparent pricing, and ease of use. You get the telematics data you need — including engine diagnostics, fault codes, and usage reporting — without the feature bloat you don't, backed by responsive support and no contractual lock-in.

If your primary need is vehicle fleet safety with AI dashcams and driver management, Motive is worth evaluating. If you operate in areas without cellular coverage, Geoforce is the only choice. And if you need extremely rugged, long-battery-life hardware for harsh industrial environments, DPL Telematics delivers purpose-built hardware that outlasts most competitors.

For most operations, start with Hapn's transparent, no-contract pricing and scale from there. The cost of the tracking system is typically recovered within the first 30-90 days through theft prevention, improved utilization, or recovered billing revenue alone.

Written by the Hapn Team

Hapn provides GPS fleet and asset tracking for 50,000+ customers across construction, equipment rental, and 50+ other industries. Our platform monitors 463,000+ assets and processes over 4 billion messages annually with 99.9% uptime.

Frequently Asked Questions

What is the best GPS tracker for construction equipment in 2026?

Hapn is the best overall GPS tracker for construction equipment in 2026, particularly for mixed fleets that include vehicles, powered heavy equipment, and unpowered assets. Hapn offers the widest range of hardware options (hardwired, battery-powered, OBD, and dash cameras) with full telematics including engine diagnostics and fault codes, transparent no-contract pricing, 99.9% platform uptime, and an open API for ERP integration. For construction companies managing 10 to 10,000+ assets, Hapn scales without requiring multi-year commitments.

Do I need a hardwired or battery-powered GPS tracker for my construction equipment?

If your equipment has a power source (engine, alternator, or battery), a hardwired tracker is always the better choice. Hardwired devices draw power from the machine, never need battery changes, and can capture engine hours and diagnostic data via the ignition wire or CAN bus. Battery-powered trackers are necessary for unpowered assets like trailers, storage containers, and generators when they're off. Most construction companies need both types — which is why choosing a platform like Hapn that supports both hardware types on one dashboard is critical.

How much does GPS tracking for construction equipment cost?

GPS tracking costs for construction equipment typically range from $15 to $50+ per device per month, depending on the provider, hardware type, and feature tier. Hardwired devices cost more upfront than battery-powered trackers, but never need battery replacements. Hapn offers transparent pricing visible on their website with no contracts, hidden fees, or setup charges. Many competitors like Samsara and Verizon Connect require a sales call to get pricing and lock you into multi-year agreements.

Can GPS trackers help prevent construction equipment theft?

Yes. GPS trackers are the single most effective tool for both preventing and recovering stolen construction equipment. Geofence alerts notify you immediately when equipment moves outside designated job sites or during off-hours. Real-time location data enables rapid recovery — and Hapn customers have recovered over $720 million in stolen assets. According to the National Equipment Register, construction equipment theft costs over $1 billion annually in the U.S., with less than 25% of stolen assets recovered without tracking technology.

What's the difference between Hapn and Samsara for construction?

Hapn and Samsara both offer GPS tracking for construction, but they serve different needs. Samsara is optimized for large vehicle fleets with compliance, driver safety, and dashcam requirements — it's a full fleet management platform. Hapn is optimized for mixed fleets where equipment tracking (engine hours, fault codes, utilization, theft prevention) is just as important as vehicle tracking. Hapn offers transparent, no-contract pricing and a broader range of equipment-specific hardware, while Samsara typically requires 3-year contracts and sales-led pricing.

Find the Right Tracker for Your Fleet

Hapn gives you one platform for your entire construction operation — vehicles, heavy equipment, and unpowered assets. No contracts, transparent pricing, 99.9% uptime.

Get Pricing →