<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<title>Equipment Rental Insurance Guide: The 2026 Owner's Playbook</title>

</head>

<body>

<article class="blog-post">

<h1>Equipment Rental Insurance: The 2026 Owner's Playbook for Risk Management</h1>

<p class="intro">

In the equipment rental industry, your inventory <em>is</em> your revenue. Every day a skid steer or generator sits in a repair shop—or worse, disappears from a job site—is a day you aren't getting paid. While carrying the right insurance is non-negotiable for protecting your balance sheet, savvy owners know that insurance is just the safety net, not the solution.

</p>

<p>

In this guide, we break down the specific coverages rental businesses need, how to structure damage waivers to boost profit, and how modern telemetry is changing the way carriers view risk.

</p>

<hr>

<h2>The Core Coverages: What Your Rental Business Actually Needs</h2>

<p>

Most general contractors carry standard liability, but rental operators face unique exposures. If you are leasing out heavy machinery, you need a policy mix that covers both the asset and the liability of its use.

</p>

<h3>1. General Liability (GL)</h3>

<p>

This is your baseline. It protects your business if your equipment causes bodily injury or property damage to a third party. However, <strong>GL rarely covers the equipment itself</strong> if it gets stolen or damaged. That is a common misconception that leaves many new owners exposed.

</p>

<h3>2. Inland Marine Coverage (The "Floater")</h3>

<p>

Despite the nautical name, Inland Marine is the standard for property that moves. Since your assets (excavators, lifts, trailers) are constantly moving between job sites, this policy covers the equipment against theft, vandalism, and damage while in transit or on a customer's site.

</p>

<h3>3. Conversion Insurance</h3>

<p>

<strong>This is critical for B2B rental houses.</strong> Standard theft policies often require "evidence of forced entry." But what happens if a customer rents a machine legitimately and then just... never returns it? That is technically "voluntary parting" or "conversion," and standard policies often deny these claims. You need specific <em>conversion coverage</em> to protect against theft by a renter.

</p>

<hr>

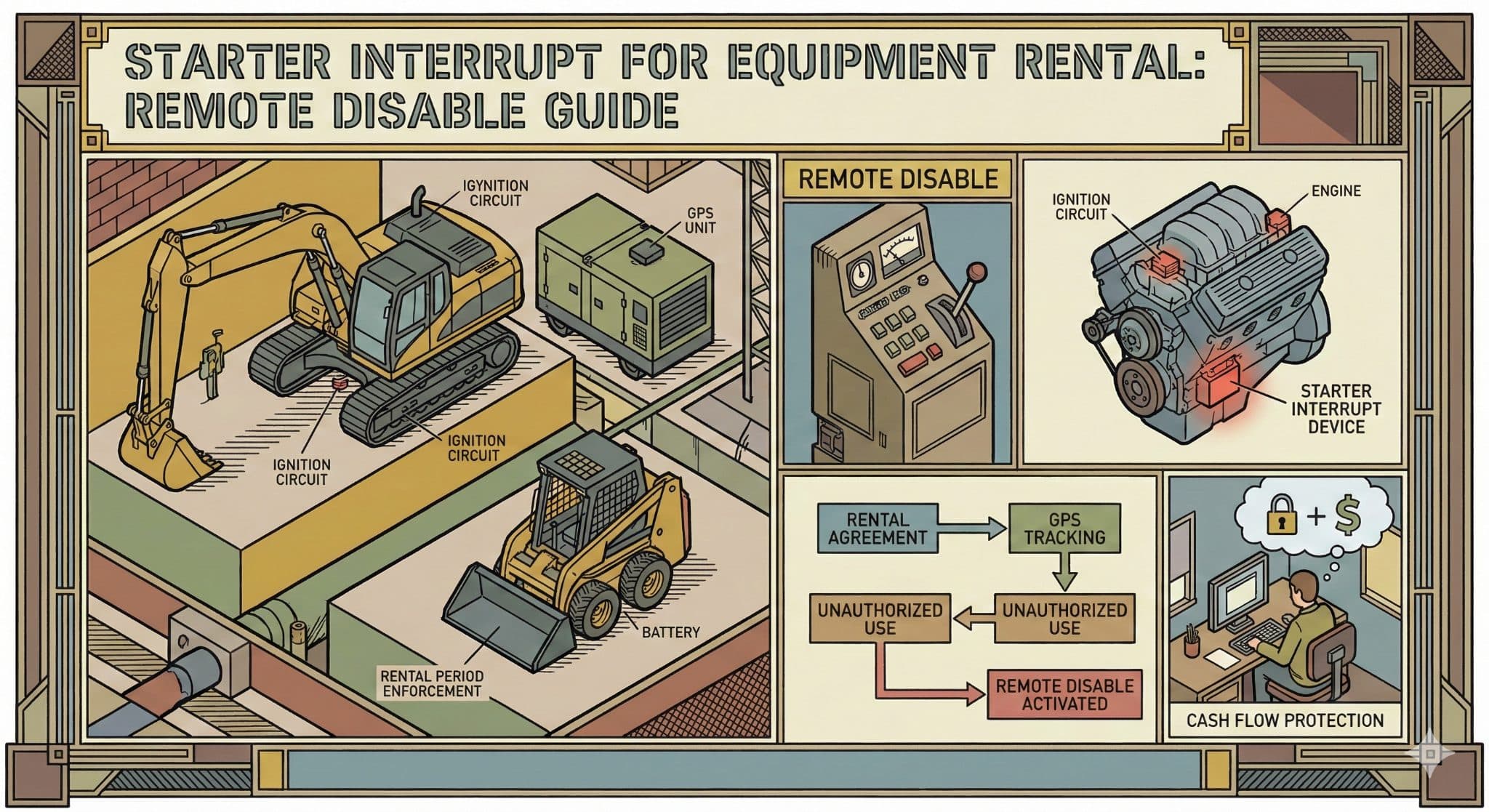

<h2>The "Insurance Gap": Why Coverage Isn't Enough</h2>

<p>

Here is the hard truth that insurance brokers rarely mention: <strong>Insurance checks don't cover downtime.</strong>

</p>

<p>

If a $60,000 boom lift is stolen, your carrier might eventually cut you a check for the replacement value. But that process can take 30 to 90 days. During those three months, that lift isn't generating its $2,500/week rental fee. You are losing market share to competitors, and you are losing revenue that the insurance check won't replace.

</p>

<p>

This is why <strong>risk mitigation</strong> is superior to risk transfer. Preventing the theft is infinitely more profitable than filing the claim.

</p>

<div style="background-color: #f4f6f8; padding: 25px; border-left: 5px solid #0056b3; margin: 30px 0;">

<h3 style="margin-top: 0;">How GPS Tracking Lowers Premiums & Prevents Claims</h3>

<p>

In 2026, many carriers are moving toward "data-driven" underwriting. By installing hardwired GPS trackers on your mixed fleet, you change the risk profile of your business.

</p>

<ul>

<li><strong>Instant Recovery:</strong> If a machine moves outside its designated Geofence after hours, you know immediately. <a href="https://gethapn.com/pages/business-fleet-gps-tracking">Modern tracking solutions</a> allow you to aid law enforcement in recovery often before the thief has left the county.</li>

<li><strong>Dispute Resolution:</strong> Customer claims the machine "didn't work" or was "returned on Friday"? Telemetry data proves exactly when and where the engine was running.</li>

<li><strong>Premium Discounts:</strong> Many insurers offer discounts for fleets equipped with active theft-recovery devices. Ask your broker about "telematics discounts."</li>

</ul>

<p>

<strong>Pro Tip:</strong> Don't just track for location. Track for utilization to ensure you aren't leaving money on the table.

</p>

</div>

<h2>Damage Waivers: Profit Center or Headache?</h2>

<p>

Many rental companies offer a Loss Damage Waiver (LDW) to customers who don't have their own equipment floater. This is not insurance; it is an agreement where you waive your right to sue the customer for certain damages in exchange for a fee (usually 10-15% of the rental rate).

</p>

<p>

<strong>Why offer it?</strong> It removes friction for smaller B2B customers and can be a significant line item for revenue. However, you must be clear about what is <em>excluded</em> (e.g., tire damage, glass, or theft due to negligence).

</p>

<hr>

<h2>FAQ: Common Rental Insurance Questions</h2>

<h3>Does my business auto policy cover my rental equipment?</h3>

<p>Typically, no. Business auto covers your delivery trucks, but once a piece of equipment (like a skid steer) is off the trailer and on the job site, the auto policy stops coverage. You need Inland Marine coverage for the equipment itself.</p>

<h3>What is a COI and why do I need one from my customers?</h3>

<p>A Certificate of Insurance (COI) proves that your B2B customer has their own liability and property coverage. Always require a COI for large rentals, and ensure your business is listed as an "Additional Insured" and "Loss Payee."</p>

<h3>How can I lower my equipment rental insurance costs?</h3>

<p>The fastest way to lower premiums is to demonstrate lower risk. This includes maintaining detailed maintenance logs, using solid rental contracts, and deploying <a href="https://gethapn.com/pages/business-fleet-gps-tracking">GPS asset tracking</a> across your high-value inventory.</p>

<br>

<p style="text-align: center; font-style: italic; color: #666;">

<em>Disclaimer: We are fleet tracking experts, not insurance agents. This guide is for informational purposes only. Always consult your broker for advice specific to your business.</em>

</p>

<div style="background-color: #333; color: #fff; padding: 40px; text-align: center; border-radius: 8px; margin-top: 40px;">

<h2 style="color: #fff; margin-bottom: 15px;">Stop Relying on Insurance Claims</h2>

<p style="font-size: 18px; margin-bottom: 25px;">Protect your inventory with the hardware and software trusted by over 50,000 businesses. Get real-time visibility on every asset you own.</p>

<a href="https://gethapn.com/pages/business-fleet-gps-tracking" style="background-color: #0056b3; color: white; padding: 15px 30px; text-decoration: none; font-weight: bold; border-radius: 5px; font-size: 18px;">Shop Asset Trackers →</a>

</div>

</article>

<script type="application/ld+json">

{

"@context": "https://schema.org",

"@type": "FAQPage",

"mainEntity": [{

"@type": "Question",

"name": "Does business auto insurance cover rental equipment?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Typically, no. Business auto policies cover the delivery vehicle, but not the equipment once it is unloaded. You need Inland Marine or Contractor's Equipment coverage for the asset itself."

}

}, {

"@type": "Question",

"name": "What is conversion coverage in equipment rental?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Conversion coverage protects you when a customer legally rents equipment but fails to return it (theft by conversion). Standard theft policies often exclude this scenario, making conversion coverage essential for rental businesses."

}

}, {

"@type": "Question",

"name": "How does GPS tracking affect insurance premiums?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Many insurance carriers offer premium discounts for fleets equipped with GPS tracking because it significantly increases the recovery rate of stolen assets and provides data to resolve liability disputes."

}

}]

}

</script>

</body>

</html>